Instructions For Form 2848 - Power Of Attorney And Declaration Of Representative - 2012

ADVERTISEMENT

Instructions for Form 2848

Department of the Treasury

Internal Revenue Service

(Rev. March 2012)

Power of Attorney and Declaration of Representative

be an individual eligible to practice before the IRS. Eligible

Section references are to the Internal Revenue Code unless

individuals are listed in Part II, Declaration of Representative, items

otherwise noted.

a-r. You may authorize a student who works in a qualified Low

General Instructions

Income Taxpayer Clinic (LITC) or Student Tax Clinic Program

(STCP) to represent you under a special order issued by the Office

of Professional Responsibility, see the instructions for Part II, later.

What’s New

Your authorization of an eligible representative will also allow that

individual to receive and inspect your confidential tax information.

Joint returns. Joint filers must now complete and submit separate

See the instructions for line 7.

Forms 2848 to have the power of attorney recorded on the IRS’s

Centralized Authorization File (CAF).

Use Form 8821, Tax Information Authorization, if you want to

authorize an individual or organization to receive or inspect your

Copies of notices and communications. You must check the

confidential tax return information, but do not want to authorize an

box next to your representative’s name and address if you want to

individual to represent you before the IRS. Use Form 4506T,

authorize the IRS to send copies of all notices and communications

Request for Transcript of Tax Return, if you want to authorize an

to your representative.

individual or organization to receive or inspect transcripts of your

Acts authorized. Check boxes have been added to assist you in

confidential return information, but do not want to authorize an

identifying certain specific acts that your representative may

individual to represent you before the IRS. This form is often used

perform. The CAF no longer records authorizations allowing your

by third parties to verify your tax compliance.

representative to receive but not endorse your refund check; the

Use Form 56, Notice Concerning Fiduciary Relationship, to

check box authorizing this act has been eliminated.

notify the IRS of the existence of a fiduciary relationship. A fiduciary

Representative designations. A new designation (i) has been

(trustee, executor, administrator, receiver, or guardian) stands in

added for registered tax return preparers. Also, the designations for

the position of a taxpayer and acts as the taxpayer, not as a

student attorneys and student certified public accountants (CPA)

representative. If a fiduciary wishes to authorize an individual to

have been combined into one designation (k). See the instructions

represent or perform certain acts on behalf of the entity, the

for Part II.

fiduciary must file a power of attorney that names the eligible

individual(s) as representative(s) for the entity. Because the

Future developments. The IRS has created a page on IRS.gov

fiduciary stands in the position of the entity, the fiduciary signs the

for Form 2848 and its instructions, at

power of attorney on behalf of the entity.

Information about any future developments affecting Form 2848

(such as legislation enacted after we release it) will be posted on

Note. Authorizing someone to represent you does not relieve you

that page.

of your tax obligations.

Purpose of Form

Where To File

Use Form 2848 to authorize an individual to represent you before

the IRS. See ‘‘Substitute Form 2848’’ for information about using a

Except as provided in this paragraph, completed Forms 2848

power of attorney other than a Form 2848 to authorize an individual

should be mailed or faxed directly to the IRS office identified in the

to represent you before the IRS. The individual you authorize must

Where To File Chart below. The exceptions are listed as follows:

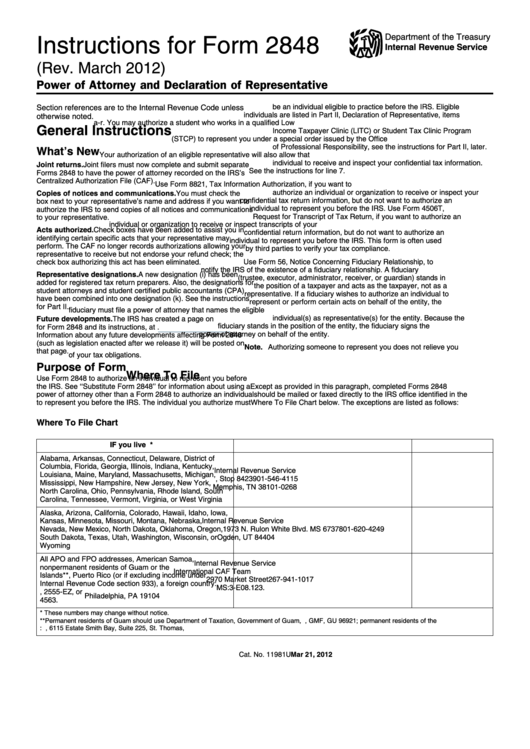

Where To File Chart

IF you live in...

THEN use this address...

Fax number*

Alabama, Arkansas, Connecticut, Delaware, District of

Columbia, Florida, Georgia, Illinois, Indiana, Kentucky,

Internal Revenue Service

Louisiana, Maine, Maryland, Massachusetts, Michigan,

P.O. Box 268, Stop 8423

901-546-4115

Mississippi, New Hampshire, New Jersey, New York,

Memphis, TN 38101-0268

North Carolina, Ohio, Pennsylvania, Rhode Island, South

Carolina, Tennessee, Vermont, Virginia, or West Virginia

Alaska, Arizona, California, Colorado, Hawaii, Idaho, Iowa,

Kansas, Minnesota, Missouri, Montana, Nebraska,

Internal Revenue Service

Nevada, New Mexico, North Dakota, Oklahoma, Oregon,

1973 N. Rulon White Blvd. MS 6737

801-620-4249

South Dakota, Texas, Utah, Washington, Wisconsin, or

Ogden, UT 84404

Wyoming

All APO and FPO addresses, American Samoa,

Internal Revenue Service

nonpermanent residents of Guam or the U.S. Virgin

International CAF Team

Islands**, Puerto Rico (or if excluding income under

2970 Market Street

267-941-1017

Internal Revenue Code section 933), a foreign country:

MS:3-E08.123.

U.S. citizens and those filing Form 2555, 2555-EZ, or

Philadelphia, PA 19104

4563.

* These numbers may change without notice.

**Permanent residents of Guam should use Department of Taxation, Government of Guam, P.O. Box 23607, GMF, GU 96921; permanent residents of the

U.S. Virgin Islands should use: V.I. Bureau of Internal Revenue, 6115 Estate Smith Bay, Suite 225, St. Thomas, V.I. 00802.

Mar 21, 2012

Cat. No. 11981U

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5