Form Di-2015c - Corporation - Partnership - Fiduciary Declaration Of Estimated Mantua, Ohio, Income Tax - 2015

ADVERTISEMENT

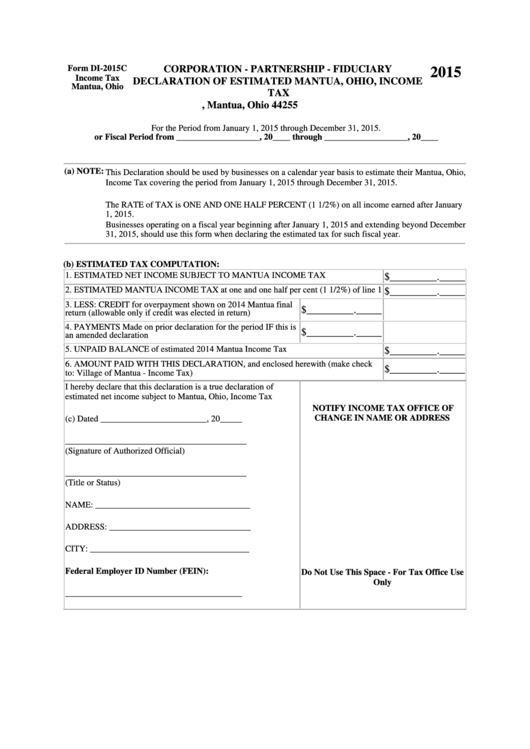

Form DI-2015C

CORPORATION - PARTNERSHIP - FIDUCIARY

2015

Income Tax

DECLARATION OF ESTIMATED MANTUA, OHIO, INCOME

Mantua, Ohio

TAX

P.O. Box 775, Mantua, Ohio 44255

For the Period from January 1, 2015 through December 31, 2015.

or Fiscal Period from ___________________, 20____ through ___________________, 20____

(a) NOTE: This Declaration should be used by businesses on a calendar year basis to estimate their Mantua, Ohio,

Income Tax covering the period from January 1, 2015 through December 31, 2015.

The RATE of TAX is ONE AND ONE HALF PERCENT (1 1/2%) on all income earned after January

1, 2015.

Businesses operating on a fiscal year beginning after January 1, 2015 and extending beyond December

31, 2015, should use this form when declaring the estimated tax for such fiscal year.

(b) ESTIMATED TAX COMPUTATION:

$_________._____

1. ESTIMATED NET INCOME SUBJECT TO MANTUA INCOME TAX

$_________._____

2. ESTIMATED MANTUA INCOME TAX at one and one half per cent (1 1/2%) of line 1

3. LESS: CREDIT for overpayment shown on 2014 Mantua final

$_________._____

return (allowable only if credit was elected in return)

4. PAYMENTS Made on prior declaration for the period IF this is

$_________._____

an amended declaration

$_________._____

5. UNPAID BALANCE of estimated 2014 Mantua Income Tax

6. AMOUNT PAID WITH THIS DECLARATION, and enclosed herewith (make check

$_________._____

to: Village of Mantua - Income Tax)

I hereby declare that this declaration is a true declaration of

estimated net income subject to Mantua, Ohio, Income Tax

NOTIFY INCOME TAX OFFICE OF

CHANGE IN NAME OR ADDRESS

(c) Dated ________________________, 20_____

_________________________________________

(Signature of Authorized Official)

_________________________________________

(Title or Status)

NAME: ___________________________________

ADDRESS: ________________________________

CITY: ____________________________________

Federal Employer ID Number (FEIN):

Do Not Use This Space - For Tax Office Use

Only

________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1