Form Nc478f - Investing In Business Property

ADVERTISEMENT

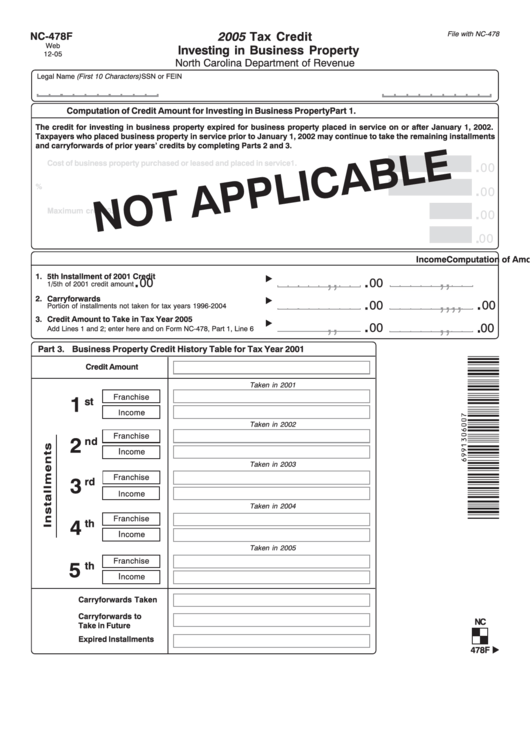

2005 Tax Credit

NC-478F

File with NC-478

Web

Investing in Business Property

12-05

North Carolina Department of Revenue

Legal Name (First 10 Characters)

SSN or FEIN

Part 1.

Computation of Credit Amount for Investing in Business Property

The credit for investing in business property expired for business property placed in service on or after January 1, 2002.

Taxpayers who placed business property in service prior to January 1, 2002 may continue to take the remaining installments

and carryforwards of prior years’ credits by completing Parts 2 and 3.

.

1.

Cost of business property purchased or leased and placed in service

00

.

2. Multiply Line 1 by 4.5%

00

.

3.

Maximum credit

00

.

4. Credit Amount for Investing in Business Property

00

Part 2.

Computation of Amount To Be Taken in 2005

Franchise

Income

,

,

.

,

,

.

1.

5th Installment of 2001 Credit

00

00

1/5th of 2001 credit amount

,

,

.

,

,

.

2.

Carryforwards

00

00

Portion of installments not taken for tax years 1996-2004

,

,

.

,

,

.

3.

Credit Amount to Take in Tax Year 2005

00

00

Add Lines 1 and 2; enter here and on Form NC-478, Part 1, Line 6

Business Property Credit History Table for Tax Year 2001

Part 3.

Credit Amount

Taken in 2001

1

Franchise

st

Income

Taken in 2002

Franchise

2

nd

I

ncome

Taken in 2003

Franchise

3

rd

Income

Taken in 2004

Franchise

4

th

I

ncome

Taken in 2005

Franchise

5

th

I

ncome

Carryforwards Taken

Carryforwards to

NC

Take in Future

Expired Installments

478F

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1