Form Sw-1 - Employer'S Quarterly Return Of Tax Withheld

ADVERTISEMENT

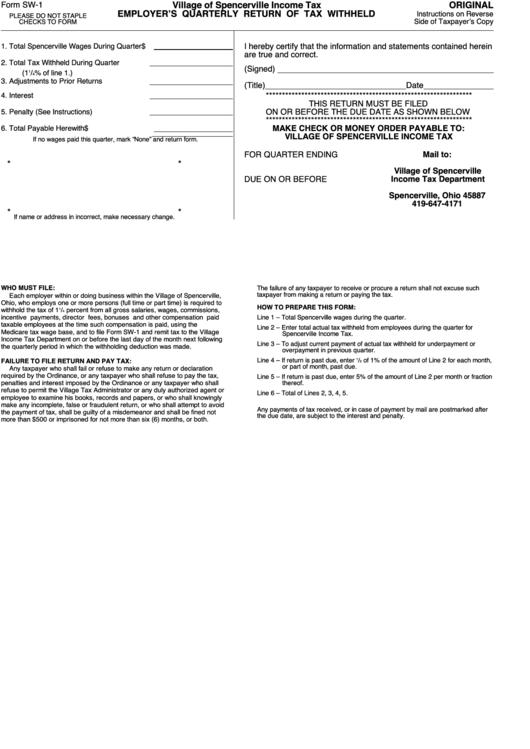

Village of Spencerville Income Tax

Form SW-1

ORIGINAL

EMPLOYER’S QUARTERLY RETURN OF TAX WITHHELD

Instructions on Reverse

PLEASE DO NOT STAPLE

Side of Taxpayer’s Copy

CHECKS TO FORM

I hereby certify that the information and statements contained herein

1. Total Spencerville Wages During Quarter

$

are true and correct.

2. Total Tax Withheld During Quarter

(Signed)

(1

1

/

% of line 1.)

4

3. Adjustments to Prior Returns

(Title)

Date

****************************************************************

4. Interest

THIS RETURN MUST BE FILED

5. Penalty (See Instructions)

ON OR BEFORE THE DUE DATE AS SHOWN BELOW

****************************************************************

MAKE CHECK OR MONEY ORDER PAYABLE TO:

6. Total Payable Herewith

$

$

VILLAGE OF SPENCERVILLE INCOME TAX

If no wages paid this quarter, mark “None” and return form.

FOR QUARTER ENDING

Mail to:

*

*

Village of Spencerville

DUE ON OR BEFORE

Income Tax Department

P.O. Box 57

Spencerville, Ohio 45887

419-647-4171

*

*

If name or address in incorrect, make necessary change.

WHO MUST FILE:

The failure of any taxpayer to receive or procure a return shall not excuse such

taxpayer from making a return or paying the tax.

Each employer within or doing business within the Village of Spencerville,

Ohio, who employs one or more persons (full time or part time) is required to

HOW TO PREPARE THIS FORM:

withhold the tax of 1

1

/

percent from all gross salaries, wages, commissions,

4

incentive payments, director fees, bonuses and other compensation paid

Line 1 – Total Spencerville wages during the quarter.

taxable employees at the time such compensation is paid, using the

Line 2 – Enter total actual tax withheld from employees during the quarter for

Medicare tax wage base, and to file Form SW-1 and remit tax to the Village

Spencerville Income Tax.

Income Tax Department on or before the last day of the month next following

Line 3 – To adjust current payment of actual tax withheld for underpayment or

the quarterly period in which the withholding deduction was made.

overpayment in previous quarter.

Line 4 – If return is past due, enter

/

of 1% of the amount of Line 2 for each month,

1

FAILURE TO FILE RETURN AND PAY TAX:

2

or part of month, past due.

Any taxpayer who shall fail or refuse to make any return or declaration

required by the Ordinance, or any taxpayer who shall refuse to pay the tax,

Line 5 – If return is past due, enter 5% of the amount of Line 2 per month or fraction

penalties and interest imposed by the Ordinance or any taxpayer who shall

thereof.

refuse to permit the Village Tax Administrator or any duly authorized agent or

Line 6 – Total of Lines 2, 3, 4, 5.

employee to examine his books, records and papers, or who shall knowingly

make any incomplete, false or fraudulent return, or who shall attempt to avoid

Any payments of tax received, or in case of payment by mail are postmarked after

the payment of tax, shall be guilty of a misdemeanor and shall be fined not

the due date, are subject to the interest and penalty.

more than $500 or imprisoned for not more than six (6) months, or both.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1