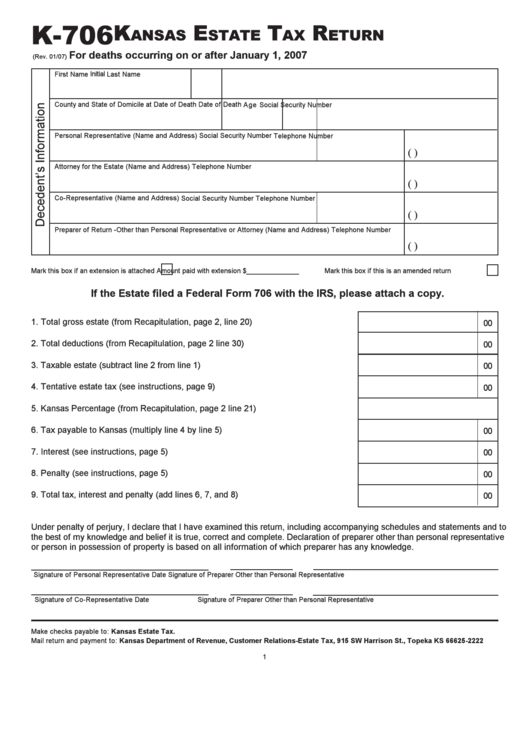

Form K-706 - Kansas Estate Tax Return - Kansas Deparetment Of Revenue - Kansas

ADVERTISEMENT

K-706

K

E

T

R

ANSAS

STATE

AX

ETURN

For deaths occurring on or after January 1, 2007

(Rev. 01/07)

Initial

First Name

Last Name

County and State of Domicile at Date of Death

Date of Death

Age

Social Security Number

Personal Representative (Name and Address)

Social Security Number

Telephone Number

(

)

Attorney for the Estate (Name and Address)

Telephone Number

(

)

Co-Representative (Name and Address)

Social Security Number

Telephone Number

(

)

Preparer of Return - Other than Personal Representative or Attorney (Name and Address)

Telephone Number

(

)

Mark this box if an extension is attached

Amount paid with extension $______________

Mark this box if this is an amended return

If the Estate filed a Federal Form 706 with the IRS, please attach a copy.

00

1. Total gross estate (from Recapitulation, page 2, line 20) .........................................

00

2. Total deductions (from Recapitulation, page 2 line 30) ............................................

00

3. Taxable estate (subtract line 2 from line 1) .............................................................

00

4. Tentative estate tax (see instructions, page 9) ........................................................

5. Kansas Percentage (from Recapitulation, page 2 line 21) .......................................

00

6. Tax payable to Kansas (multiply line 4 by line 5) ....................................................

00

7. Interest (see instructions, page 5) ..........................................................................

00

8. Penalty (see instructions, page 5) ..........................................................................

00

9. Total tax, interest and penalty (add lines 6, 7, and 8) .............................................

Under penalty of perjury, I declare that I have examined this return, including accompanying schedules and statements and to

the best of my knowledge and belief it is true, correct and complete. Declaration of preparer other than personal representative

or person in possession of property is based on all information of which preparer has any knowledge.

Signature of Personal Representative

Date

Signature of Preparer Other than Personal Representative

Signature of Co-Representative

Date

Signature of Preparer Other than Personal Representative

Make checks payable to: Kansas Estate Tax.

Mail return and payment to: Kansas Department of Revenue, Customer Relations-Estate Tax, 915 SW Harrison St., Topeka KS 66625-2222

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17