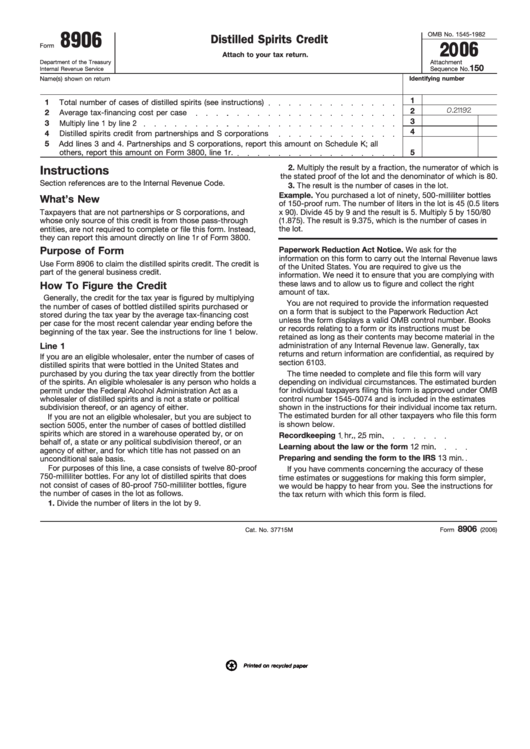

8906

OMB No. 1545-1982

Distilled Spirits Credit

2006

Form

Attach to your tax return.

Attachment

Department of the Treasury

150

Internal Revenue Service

Sequence No.

Name(s) shown on return

Identifying number

1

1

Total number of cases of distilled spirits (see instructions)

2

0.21192

2

Average tax-financing cost per case

3

3

Multiply line 1 by line 2

4

4

Distilled spirits credit from partnerships and S corporations

5

Add lines 3 and 4. Partnerships and S corporations, report this amount on Schedule K; all

others, report this amount on Form 3800, line 1r.

5

2. Multiply the result by a fraction, the numerator of which is

Instructions

the stated proof of the lot and the denominator of which is 80.

Section references are to the Internal Revenue Code.

3. The result is the number of cases in the lot.

Example. You purchased a lot of ninety, 500-milliliter bottles

What’s New

of 150-proof rum. The number of liters in the lot is 45 (0.5 liters

Taxpayers that are not partnerships or S corporations, and

x 90). Divide 45 by 9 and the result is 5. Multiply 5 by 150/80

(1.875). The result is 9.375, which is the number of cases in

whose only source of this credit is from those pass-through

entities, are not required to complete or file this form. Instead,

the lot.

they can report this amount directly on line 1r of Form 3800.

Purpose of Form

Paperwork Reduction Act Notice. We ask for the

information on this form to carry out the Internal Revenue laws

Use Form 8906 to claim the distilled spirits credit. The credit is

of the United States. You are required to give us the

part of the general business credit.

information. We need it to ensure that you are complying with

these laws and to allow us to figure and collect the right

How To Figure the Credit

amount of tax.

Generally, the credit for the tax year is figured by multiplying

You are not required to provide the information requested

the number of cases of bottled distilled spirits purchased or

on a form that is subject to the Paperwork Reduction Act

stored during the tax year by the average tax-financing cost

unless the form displays a valid OMB control number. Books

per case for the most recent calendar year ending before the

or records relating to a form or its instructions must be

beginning of the tax year. See the instructions for line 1 below.

retained as long as their contents may become material in the

administration of any Internal Revenue law. Generally, tax

Line 1

returns and return information are confidential, as required by

If you are an eligible wholesaler, enter the number of cases of

section 6103.

distilled spirits that were bottled in the United States and

purchased by you during the tax year directly from the bottler

The time needed to complete and file this form will vary

of the spirits. An eligible wholesaler is any person who holds a

depending on individual circumstances. The estimated burden

permit under the Federal Alcohol Administration Act as a

for individual taxpayers filing this form is approved under OMB

wholesaler of distilled spirits and is not a state or political

control number 1545-0074 and is included in the estimates

shown in the instructions for their individual income tax return.

subdivision thereof, or an agency of either.

The estimated burden for all other taxpayers who file this form

If you are not an eligible wholesaler, but you are subject to

is shown below.

section 5005, enter the number of cases of bottled distilled

spirits which are stored in a warehouse operated by, or on

Recordkeeping

1 hr., 25 min.

behalf of, a state or any political subdivision thereof, or an

Learning about the law or the form

12 min.

agency of either, and for which title has not passed on an

Preparing and sending the form to the IRS

13 min.

unconditional sale basis.

For purposes of this line, a case consists of twelve 80-proof

If you have comments concerning the accuracy of these

750-milliliter bottles. For any lot of distilled spirits that does

time estimates or suggestions for making this form simpler,

not consist of cases of 80-proof 750-milliliter bottles, figure

we would be happy to hear from you. See the instructions for

the number of cases in the lot as follows.

the tax return with which this form is filed.

1. Divide the number of liters in the lot by 9.

8906

Cat. No. 37715M

Form

(2006)

1

1