Form B-37 Instructions

ADVERTISEMENT

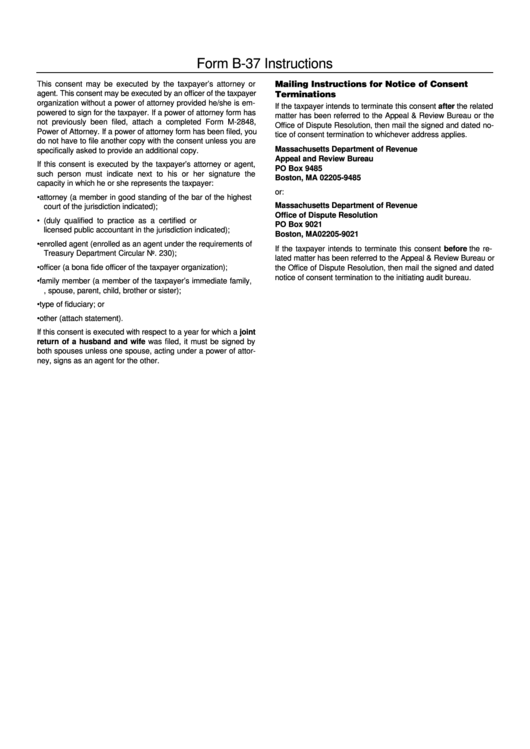

Form B-37 Instructions

This consent may be executed by the taxpayer’s attorney or

Mailing Instructions for Notice of Consent

agent. This consent may be executed by an officer of the taxpayer

Terminations

organization without a power of attorney provided he/she is em-

If the taxpayer intends to terminate this consent after the related

powered to sign for the taxpayer. If a power of attorney form has

matter has been referred to the Appeal & Review Bureau or the

not previously been filed, attach a completed Form M-2848,

Office of Dispute Resolution, then mail the signed and dated no-

Power of Attorney. If a power of attorney form has been filed, you

tice of consent termination to whichever address applies.

do not have to file another copy with the consent unless you are

Massachusetts Department of Revenue

specifically asked to provide an additional copy.

Appeal and Review Bureau

If this consent is executed by the taxpayer’s attorney or agent,

PO Box 9485

such person must indicate next to his or her signature the

Boston, MA 02205-9485

capacity in which he or she represents the taxpayer:

or:

• attorney (a member in good standing of the bar of the highest

Massachusetts Department of Revenue

court of the jurisdiction indicated);

Office of Dispute Resolution

• C.P.A. or L.P.A. (duly qualified to practice as a certified or

PO Box 9021

licensed public accountant in the jurisdiction indicated);

Boston, MA 02205-9021

• enrolled agent (enrolled as an agent under the requirements of

If the taxpayer intends to terminate this consent before the re-

Treasury Department Circular No. 230);

lated matter has been referred to the Appeal & Review Bureau or

• officer (a bona fide officer of the taxpayer organization);

the Office of Dispute Resolution, then mail the signed and dated

notice of consent termination to the initiating audit bureau.

• family member (a member of the taxpayer’s immediate family,

e.g., spouse, parent, child, brother or sister);

• type of fiduciary; or

• other (attach statement).

If this consent is executed with respect to a year for which a joint

return of a husband and wife was filed, it must be signed by

both spouses unless one spouse, acting under a power of attor-

ney, signs as an agent for the other.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1