Form Ctx-Ftr - City Of New York Cigarette Floor Tax Return - 2002

ADVERTISEMENT

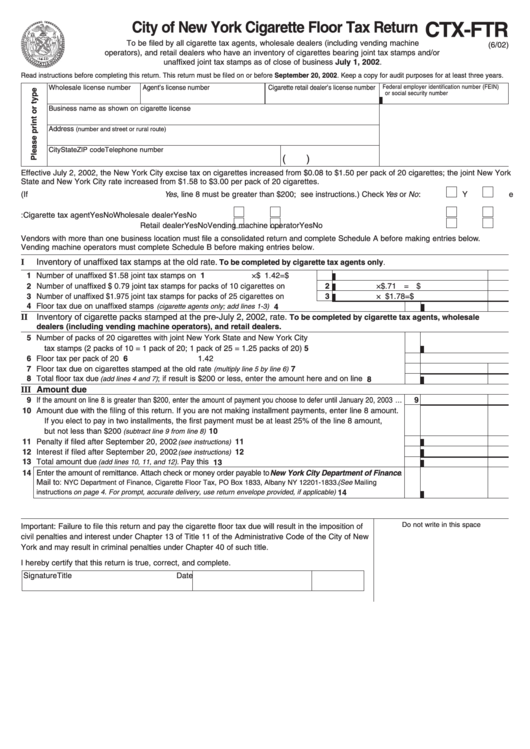

City of New York Cigarette Floor Tax Return

CTX-FTR

To be filed by all cigarette tax agents, wholesale dealers (including vending machine

(6/02)

operators), and retail dealers who have an inventory of cigarettes bearing joint tax stamps and/or

unaffixed joint tax stamps as of close of business July 1, 2002.

Read instructions before completing this return. This return must be filed on or before September 20, 2002. Keep a copy for audit purposes for at least three years.

Federal employer identification number (FEIN)

Wholesale license number

Agent’s license number

Cigarette retail dealer’s license number

or social security number

Business name as shown on cigarette license

Address

(number and street or rural route)

City

State

ZIP code

Telephone number

(

)

Effective July 2, 2002, the New York City excise tax on cigarettes increased from $0.08 to $1.50 per pack of 20 cigarettes; the joint New York

State and New York City rate increased from $1.58 to $3.00 per pack of 20 cigarettes.

A.

Election to pay in two installments (If Yes , line 8 must be greater than $200; see instructions.) Check Yes or No :

Yes

No

B.

Business activities:

Cigarette tax agent

Yes

No

Wholesale dealer

Yes

No

Retail dealer

Yes

No

Vending machine operator

Yes

No

Vendors with more than one business location must file a consolidated return and complete Schedule A before making entries below.

Vending machine operators must complete Schedule B before making entries below.

I

Inventory of unaffixed tax stamps at the old rate.

To be completed by cigarette tax agents only.

1 Number of unaffixed $1.58 joint tax stamps on hand ............................................

1

×$ 1.42 = $

2 Number of unaffixed $ 0.79 joint tax stamps for packs of 10 cigarettes on hand ...

2

×

$.71 = $

3 Number of unaffixed $1.975 joint tax stamps for packs of 25 cigarettes on hand ...

3

× $1.78 = $

4 Floor tax due on unaffixed stamps

...........................................................

(cigarette agents only; add lines 1-3)

4

II Inventory of cigarette packs stamped at the pre-July 2, 2002, rate.

To be completed by cigarette tax agents, wholesale

dealers (including vending machine operators), and retail dealers.

5 Number of packs of 20 cigarettes with joint New York State and New York City

tax stamps (2 packs of 10 = 1 pack of 20; 1 pack of 25 = 1.25 packs of 20) ..............................................

5

6 Floor tax per pack of 20 cigarettes ................................................................................................................

6

1.42

7 Floor tax due on cigarettes stamped at the old rate

...................................................

7

(multiply line 5 by line 6)

8 Total floor tax due

; if result is $200 or less, enter the amount here and on line 10 ............

(add lines 4 and 7)

8

III Amount due

9 If the amount on line 8 is greater than $200, enter the amount of payment you choose to defer until January 20, 2003 ...

9

10 Amount due with the filing of this return. If you are not making installment payments, enter line 8 amount.

If you elect to pay in two installments, the first payment must be at least 25% of the line 8 amount,

but not less than $200

......................................................................................... 10

(subtract line 9 from line 8)

11 Penalty if filed after September 20, 2002

............................................................................. 11

(see instructions)

12 Interest if filed after September 20, 2002

............................................................................. 12

(see instructions)

13 Total amount due

Pay this amount ........................................................................... 13

(add lines 10, 11, and 12).

14 Enter the amount of remittance. Attach check or money order payable to New York City Department of Finance .

Mail to:

NYC Department of Finance, Cigarette Floor Tax, PO Box 1833, Albany NY 12201-1833. (See Mailing

............................. 14

instructions on page 4. For prompt, accurate delivery, use return envelope provided, if applicable)

Do not write in this space

Important: Failure to file this return and pay the cigarette floor tax due will result in the imposition of

civil penalties and interest under Chapter 13 of Title 11 of the Administrative Code of the City of New

York and may result in criminal penalties under Chapter 40 of such title.

I hereby certify that this return is true, correct, and complete.

Signature

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3