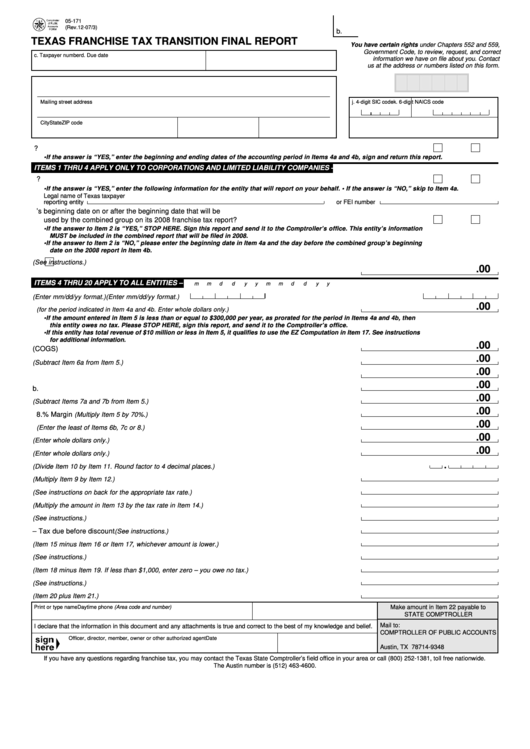

05-171

PRINT FORM

CLEAR FIELDS

(Rev.12-07/3)

b.

TEXAS FRANCHISE TAX TRANSITION FINAL REPORT

You have certain rights under Chapters 552 and 559,

Government Code, to review, request, and correct

c. Taxpayer number

d. Due date

information we have on file about you. Contact

us at the address or numbers listed on this form.

h.PM

g. Taxpayer name

Mailing street address

j. 4-digit SIC code

k. 6-digit NAICS code

City

State

ZIP code

l.Texas Secretary of State file number

m. Is this entity a partnership or trust that meets the passive entity criteria in Texas Tax Code Section 171.0003? .....................

YES

NO

• If the answer is “YES,” enter the beginning and ending dates of the accounting period in Items 4a and 4b, sign and return this report.

ITEMS 1 THRU 4 APPLY ONLY TO CORPORATIONS AND LIMITED LIABILITY COMPANIES –

1. Is this entity a member of an affiliated group that will be required to file a combined report in 2008? ......................................

YES

NO

• If the answer is “YES,” enter the following information for the entity that will report on your behalf. • If the answer is “NO,” skip to Item 4a.

Legal name of

Texas taxpayer

reporting entity

or FEI number

2. Is this entity’s beginning date on or after the beginning date that will be

used by the combined group on its 2008 franchise tax report? ...................................................................................................

YES

NO

• If the answer to Item 2 is “YES,” STOP HERE. Sign this report and send it to the Comptroller’s office. This entity’s information

MUST be included in the combined report that will be filed in 2008.

• If the answer to Item 2 is “NO,” please enter the beginning date in Item 4a and the day before the combined group’s beginning

date on the 2008 report in Item 4b.

3a.

Check this box if you want to preserve the right to take the temporary credit.

(See instructions.)

.00

3b. Cumulative amount of unexhausted business loss carryforwards through the 2007 report ............ 3b.

ITEMS 4 THRU 20 APPLY TO ALL ENTITIES –

m

m

d

d

y

y

m

m

d

d

y

y

4a. Begin date

(Enter mm/dd/yy format.)

..............

4b. End date

(Enter mm/dd/yy format.)

............

.00

5. Total revenue

................................... 5.

(for the period indicated in Item 4a and 4b. Enter whole dollars only.)

• If the amount entered in Item 5 is less than or equal to $300,000 per year, as prorated for the period in Items 4a and 4b, then

this entity owes no tax. Please STOP HERE, sign this report, and send it to the Comptroller’s office.

• If this entity has total revenue of $10 million or less in Item 5, it qualifies to use the EZ Computation in Item 17. See instructions

for additional information.

.00

6a. Cost of Goods Sold (COGS) .............................................................................................................. 6a.

.00

6b. COGS Margin

(Subtract Item 6a from Item 5.)

.................................................................................... 6b.

.00

7a. Wages and cash compensation ......................................................................................................... 7a.

.00

7b. Employee benefits .............................................................................................................................. 7b.

.00

7c. Compensation margin

.......................................................... 7c.

(Subtract Items 7a and 7b from Item 5.)

.00

8. % Margin

(Multiply Item 5 by 70%.)

....................................................................................................... 8.

.00

9. Margin

(Enter the least of Items 6b, 7c or 8.)

......................................................................................... 9.

.00

10. Gross receipts in Texas

............................................................................. 10.

(Enter whole dollars only.)

.00

11. Gross receipts everywhere

....................................................................... 11.

(Enter whole dollars only.)

12. Apportionment factor

(Divide Item 10 by Item 11. Round factor to 4 decimal places.)

......................... 12.

13. Taxable margin

....................................................................................... 13.

(Multiply Item 9 by Item 12.)

14. Tax rate

.......................................................... 14.

(See instructions on back for the appropriate tax rate.)

15. Tax due before discount

.......................... 15.

(Multiply the amount in Item 13 by the tax rate in Item 14.)

16. Credits

(See instructions.)

................................................................................................................... 16.

17. EZ Computation – Tax due before discount

......................................................... 17.

(See instructions.)

18. Subtotal

............................................ 18.

(Item 15 minus Item 16 or Item 17, whichever amount is lower.)

19. Discount

................................................................................................................. 19.

(See instructions.)

20. Tax due

(Item 18 minus Item 19. If less than $1,000, enter zero – you owe no tax.)

............................. 20.

21. Penalty and interest

.............................................................................................. 21.

(See instructions.)

22. TOTAL AMOUNT DUE AND PAYABLE

.......................................................... 22.

(Item 20 plus Item 21.)

Print or type name

Daytime phone (Area code and number)

Make amount in Item 22 payable to

STATE COMPTROLLER

Mail to:

I declare that the information in this document and any attachments is true and correct to the best of my knowledge and belief.

COMPTROLLER OF PUBLIC ACCOUNTS

Officer, director, member, owner or other authorized agent

Date

P.O. Box 149348

Austin, TX 78714-9348

If you have any questions regarding franchise tax, you may contact the Texas State Comptroller’s field office in your area or call (800) 252-1381, toll free nationwide.

The Austin number is (512) 463-4600.

1

1