Multiple Activities Tax Credit Form

ADVERTISEMENT

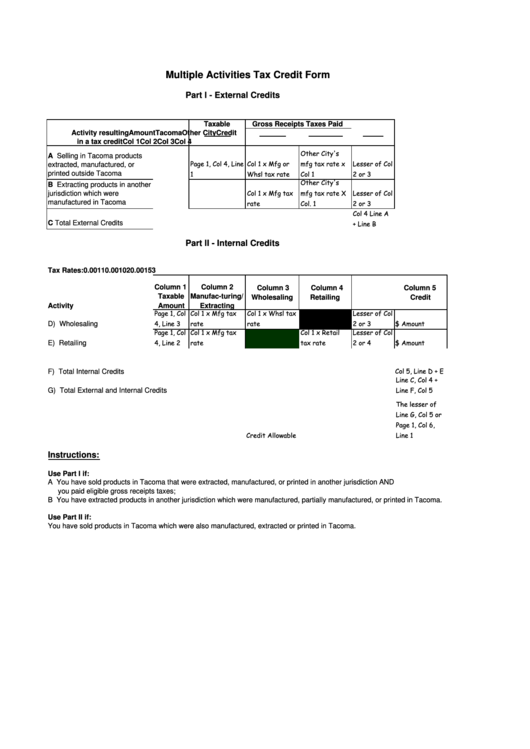

Multiple Activities Tax Credit Form

Part I - External Credits

Taxable

Gross Receipts Taxes Paid

Activity resulting

Amount

Tacoma

Other City

Credit

in a tax credit

Col 1

Col 2

Col 3

Col 4

Other City's

A Selling in Tacoma products

Page 1, Col 4, Line

Col 1 x Mfg or

mfg tax rate x

Lesser of Col

extracted, manufactured, or

1

Whsl tax rate

Col 1

2 or 3

printed outside Tacoma

Other City's

B Extracting products in another

Col 1 x Mfg tax

mfg tax rate X

Lesser of Col

jurisdiction which were

rate

Col. 1

2 or 3

manufactured in Tacoma

Col 4 Line A

+ Line B

C Total External Credits

Part II - Internal Credits

Tax Rates:

0.0011

0.00102

0.00153

Column 1

Column 2

Column 3

Column 4

Column 5

Taxable

Manufac-turing/

Wholesaling

Retailing

Credit

Activity

Amount

Extracting

Page 1, Col

Col 1 x Mfg tax

Col 1 x Whsl tax

Lesser of Col

4, Line 3

rate

rate

2 or 3

$ Amount

D) Wholesaling

Page 1, Col

Col 1 x Mfg tax

Col 1 x Retail

Lesser of Col

4, Line 2

rate

tax rate

2 or 4

$ Amount

E) Retailing

Col 5, Line D + E

F) Total Internal Credits

Line C, Col 4 +

Line F, Col 5

G) Total External and Internal Credits

The lesser of

Line G, Col 5 or

Page 1, Col 6,

Credit Allowable

Line 1

Instructions:

Use Part I if:

A You have sold products in Tacoma that were extracted, manufactured, or printed in another jurisdiction AND

you paid eligible gross receipts taxes;

B You have extracted products in another jurisdiction which were manufactured, partially manufactured, or printed in Tacoma.

Use Part II if:

You have sold products in Tacoma which were also manufactured, extracted or printed in Tacoma.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1