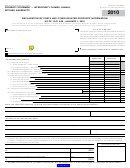

BOE-517-EG (S1B) REV. 3 (12-05)

Under the provisions of sections 826 and 830 of the Revenue and Taxation Code and section 901, Title 18, California

Code of Regulations, the Board of Equalization requests that you file a property statement with this Board between

January 1, 2006, and 5:00 p.m., on March 1, 2006. The property statement shall be completed in accordance with

instructions included with the property statement and in publication 67-EG, Instructions for Reporting State-Assessed

Property, for lien date 2006. If you do not have these instructions, please let us know and we will mail them to you.

All parts of the property statement must be filed by March 1, 2006 (exception — see “N/A” below). Extensions of time for

filing the property statement or any of its parts may be granted only on a showing of good cause under a written request

made prior to March 1, 2006, as provided by section 830.1 of the Revenue and Taxation Code. If you do not file timely, it

will result in an added penalty of ten percent of the assessed value as required by section 830 of the Revenue and

Taxation Code.

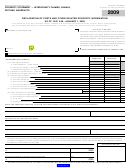

(6) OTHER INFORMATION — INSTRUCTIONS

The following information shall be provided with the property statements:

a. A copy of your quarterly CEC 1304 reports (1st to 4th) to the California Energy Commission (CEC) for calendar

year 2005

b. A copy of your annual report to owners for calendar year 2005

c. Comparative Balance Sheet for year ending December 31, 2005 and year ending December 31, 2004

d. A copy of all power purchase agreements and any other revenue contracts in place on the lien date

e. A copy of all engineering, procurement, and construction contracts

f.

A copy of all plant management and/or operation and maintenance contracts

g. A copy of all RMR contracts including all schedules, exhibits, and attachments

h. Other information as requested

A positive response is required for all parts of the property statement. If a requested item does not apply, please so

state. If you do not respond to all parts of the property statement, it may subject you to the penalties of section 830 of the

Revenue and Taxation Code.

N/A — Not Applicable

Forms BOE-600-A, BOE-600-B, and BOE-551, Statement of Land Changes, need not be returned if there is nothing to

report. However, a positive response under the “N/A” column on page S1F is required for those forms not returned.

Report book cost (100 percent of actual cost). Include excise, sales and use taxes, freight-in, installation charges,

finance charges during construction, and all other relevant costs required to place the property in service. Do not reduce

costs for depreciation (which must be reported separately). Report separately the details of any trade-in value, write-

downs of cost, extraordinary damage or obsolescence, or any other information that may help the Board in estimating

fair market value.

Note: All replacement cost studies, obsolescence requests, and other voluntary information that an assessee

believes affects the value of their property must be filed with the property statement or by a date granted by a formal

extension. If such information is not filed by that date, staff is not required to consider it in determining its unitary value

recommendation.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13