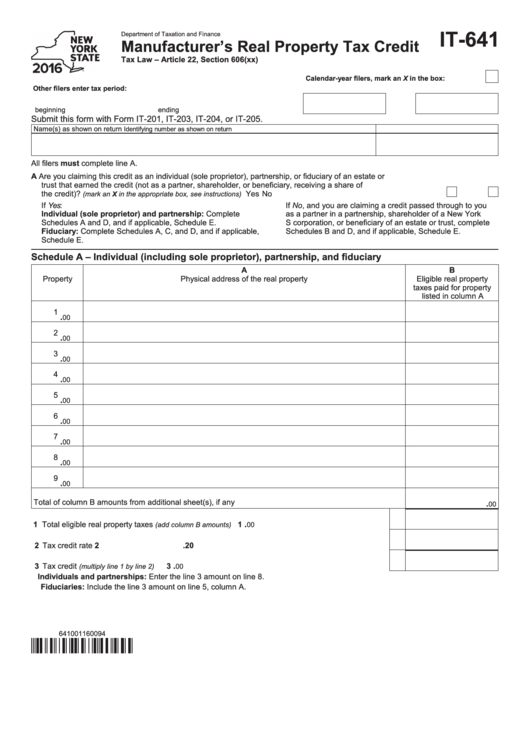

IT-641

Department of Taxation and Finance

Manufacturer’s Real Property Tax Credit

Tax Law – Article 22, Section 606(xx)

Calendar-year filers, mark an X in the box:

Other filers enter tax period:

beginning

ending

Submit this form with Form IT‑201, IT‑203, IT‑204, or IT‑205.

Name(s) as shown on return

Identifying number as shown on return

All filers must complete line A.

A Are you claiming this credit as an individual (sole proprietor), partnership, or fiduciary of an estate or

trust that earned the credit (not as a partner, shareholder, or beneficiary, receiving a share of

the credit)?

.................................................................................... Yes

No

(mark an X in the appropriate box, see instructions)

If Yes:

If No, and you are claiming a credit passed through to you

Individual (sole proprietor) and partnership: Complete

as a partner in a partnership, shareholder of a New York

Schedules A and D, and if applicable, Schedule E.

S corporation, or beneficiary of an estate or trust, complete

Fiduciary: Complete Schedules A, C, and D, and if applicable,

Schedules B and D, and if applicable, Schedule E.

Schedule E.

Schedule A – Individual (including sole proprietor), partnership, and fiduciary

A

B

Property

Physical address of the real property

Eligible real property

taxes paid for property

listed in column A

1

.

00

2

.

00

3

.

00

4

.

00

5

.

00

6

.

00

7

.

00

8

.

00

9

.

00

Total of column B amounts from additional sheet(s), if any .............................................................................

.

00

.

1 Total eligible real property taxes

......................................................................

1

(add column B amounts)

00

2 Tax credit rate ......................................................................................................................................

2

.20

.

3 Tax credit

..........................................................................................................

3

(multiply line 1 by line 2)

00

Individuals and partnerships: Enter the line 3 amount on line 8.

Fiduciaries: Include the line 3 amount on line 5, column A.

641001160094

1

1 2

2 3

3