Tax Rates Chart, Transaction Privilege (Sales) Tax Return Form Instructions Etc.

ADVERTISEMENT

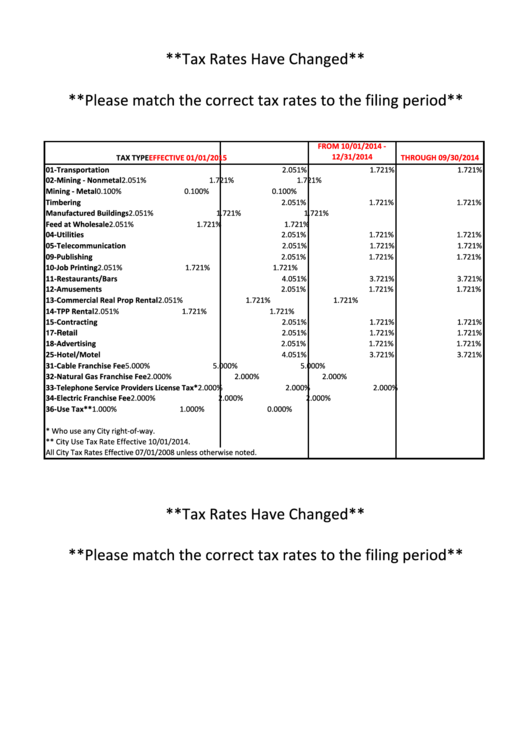

**Tax Rates Have Changed**

**Please match the correct tax rates to the filing period**

FROM 10/01/2014 -

12/31/2014

TAX TYPE

EFFECTIVE 01/01/2015

THROUGH 09/30/2014

01-Transportation

2.051%

1.721%

1.721%

02-Mining - Nonmetal

2.051%

1.721%

1.721%

Mining - Metal

0.100%

0.100%

0.100%

Timbering

2.051%

1.721%

1.721%

Manufactured Buildings

2.051%

1.721%

1.721%

Feed at Wholesale

2.051%

1.721%

1.721%

04-Utilities

2.051%

1.721%

1.721%

05-Telecommunication

2.051%

1.721%

1.721%

09-Publishing

2.051%

1.721%

1.721%

10-Job Printing

2.051%

1.721%

1.721%

11-Restaurants/Bars

4.051%

3.721%

3.721%

12-Amusements

2.051%

1.721%

1.721%

13-Commercial Real Prop Rental

2.051%

1.721%

1.721%

14-TPP Rental

2.051%

1.721%

1.721%

15-Contracting

2.051%

1.721%

1.721%

2.051%

1.721%

1.721%

17-Retail

18-Advertising

2.051%

1.721%

1.721%

25-Hotel/Motel

4.051%

3.721%

3.721%

31-Cable Franchise Fee

5.000%

5.000%

5.000%

32-Natural Gas Franchise Fee

2.000%

2.000%

2.000%

33-Telephone Service Providers License Tax*

2.000%

2.000%

2.000%

34-Electric Franchise Fee

2.000%

2.000%

2.000%

36-Use Tax**

1.000%

1.000%

0.000%

* Who use any City right-of-way.

** City Use Tax Rate Effective 10/01/2014.

All City Tax Rates Effective 07/01/2008 unless otherwise noted.

**Tax Rates Have Changed**

**Please match the correct tax rates to the filing period**

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5