Form Sev-400 - Severance Tax Estimate - 2005

ADVERTISEMENT

I 6 l

TOTAL I THRU 5

I

I

(GROSS AMOUNT OF TAXI

I

WVISN400

REV

7/05

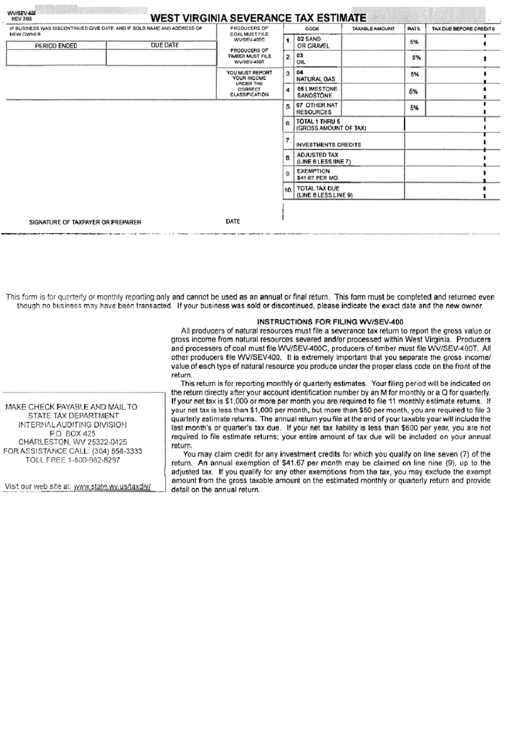

WEST VIRGINIA SEVERANCE TAX ESTIME

.

,

I

SIGNATURE OF TAXPAYER OR PREPARER

DATE

- - - . - - . - - - - - - . . - -

.

..

~

~

,...

, - . - ,

* ~ - .

~

t p

IF BUSINESS WAS DISCONTINUED GIVE DATE AND IF SOLD NAME AND ADDRESS OF

NEW OWNER

7.

8,

10.

This form is for qu~rterly or monthly reporting only and cannot be used as an annual or final return. This form must be completed and returned even

tihough no business may have been transacted. If your business was sold or discontinued, please indicate the exact date and the new owner.

PERIOD ENDED

MAKE CHECK PAYABLE AND MAIL TO:

STATE TAX DEPARTMENT

IP~TERPIAIAUDITING DIVISIObI

P.O. EOX 425

CHARLESTON, W\/ 25322-0425

FOR ASSISTANCE CALL: (304) 558-3333

TOLL FREE 1-800-982-8297

PRODUCERS OF

COAL MUST FILE

WVISEV4OOC

PRODUCERS OF

TIMBER MUST FlLE

WV/SR"4OOT

YOUMUSTREPORT

YOUR INCOME

UNDER THE

CORRECT

CLASSIFICATION

DUE

DATE

INVESTMENTS CREDITS

ADJUSTED TAX

(LINE

6 LESS

IlNE

7)

EXEMPTION

$41.67 PER

MO.

TOTAL TAX DUE

(LINE 8 LESS

LINE

9)

INSTRUCTIONS FOR FILING WVISEV-400

All producers of natural resources must file a severance tax return to report the gross value or

gross income from natural resources severed andlor processed within West Virginia. Producers

and processers of coal must file WVISEV-4OOC, producers of timber must file WVISEV-400T. All

other producers file WVlSEV400. It is extremely important that you separate the gross income1

value of each type of natural resource you produce under the proper class code on the front of the

return.

This return is for reporting morithly or quarterly estimates. Your filing period will be indicated on

the return directly after your account identification number by an M for monthly or a Q for quarterly.

If your net tax is $1,000 or more per month you are required to file 11 monthly estimate returns. If

your net tax is less than $1,000 per month, but more than $50 per month, you are required to file 3

quarterly estimate returns. The annual return you file at the end of your taxable yearwill include the

last month's or quarter's tax due. If your net tax liability is less than $600 per year, you are not

required to file estimate returns; your entire amount of tax due will be included on your annual

return.

You may claim credit for any investment credits for which you qualify on line seven (7) of the

return. An annual exemption of $41.67 per month may be claimed on line nine (9), up to the

TAXABLE AMOUNT

5,

I

I

I

I

I

I

I

I

I

adjusted tax. If you qualify for any other exemptions from the tax, you may exclude the exempt

5%

07 OTHER NAT

RESOURCES

CODE

amount from the gross taxable amount on the estimated monthly or quarterly return and provide

V I S I ~

O U T

web

B!C

at

Y ~ N ~ N

slate w uslfaxdivl

1

- -

detail on the annual return.

I

I

RATE

5%

5%

5%

5%

1,

.

2,

3

4.

I

TAX DUE BEFORE CREDITS

I

I

I

I

I

I

I

-

02 SAND

OR GRAVEL

03

OIL

04

NATURAL GAS

05 LIMESTONE

SANDSTONE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1