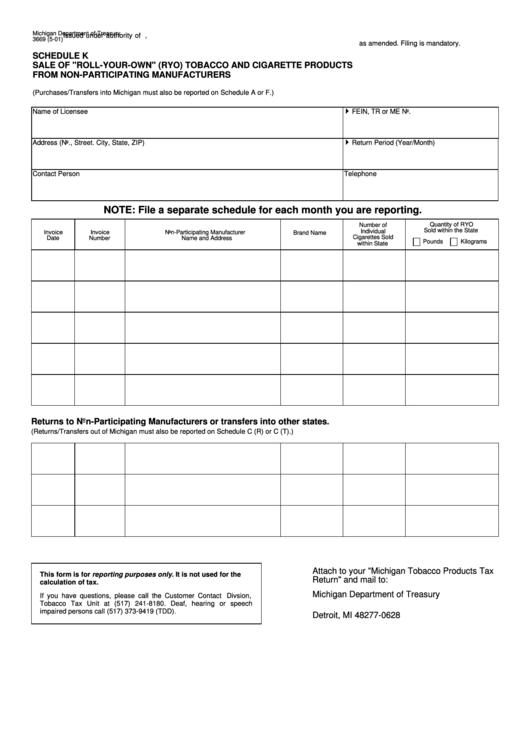

Form 3669 - Schedule K Sale Of "Roll-Your-Own" (Ryo) Tobacco And Cigarette Products From Non-Participating Manufacturers May 2001

ADVERTISEMENT

Michigan Department of Treasury

Issued under authority of P.A. 327 of 1993,

3669 (5-01)

as amended. Filing is mandatory.

SCHEDULE K

SALE OF "ROLL-YOUR-OWN" (RYO) TOBACCO AND CIGARETTE PRODUCTS

FROM NON-PARTICIPATING MANUFACTURERS

(Purchases/Transfers into Michigan must also be reported on Schedule A or F.)

4

Name of Licensee

FEIN, TR or ME No.

4

Address (No., Street. City, State, ZIP)

Return Period (Year/Month)

Contact Person

Telephone

NOTE: File a separate schedule for each month you are reporting.

Quantity of RYO

Number of

Sold within the State

Individual

Invoice

Invoice

Non-Participating Manufacturer

Brand Name

Cigarettes Sold

Date

Number

Name and Address

Pounds

Kilograms

within State

Returns to Non-Participating Manufacturers or transfers into other states.

(Returns/Transfers out of Michigan must also be reported on Schedule C (R) or C (T).)

Attach to your "Michigan Tobacco Products Tax

This form is for reporting purposes only. It is not used for the

Return" and mail to:

calculation of tax.

Michigan Department of Treasury

If you have questions, please call the Customer Contact Divsion,

Tobacco Tax Unit at (517) 241-8180. Deaf, hearing or speech

P.O. Box 77628

impaired persons call (517) 373-9419 (TDD).

Detroit, MI 48277-0628

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1