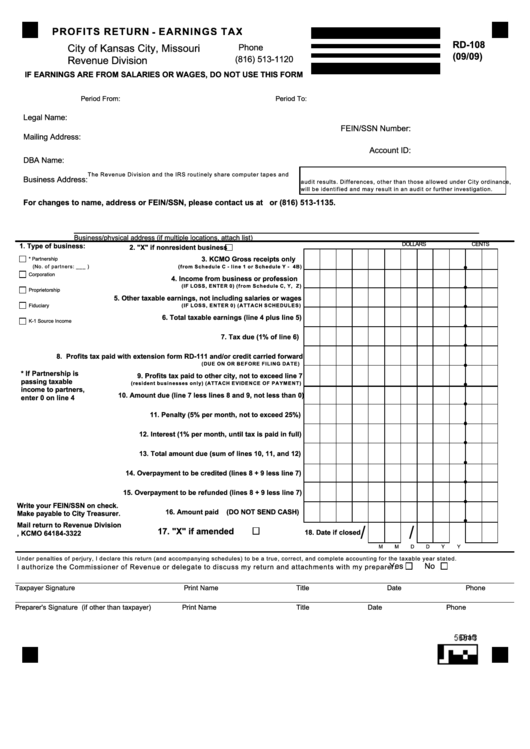

PROFITS RETURN - EARNINGS TAX

RD-108

City of Kansas City, Missouri

Phone

(09/09)

(816) 513-1120

Revenue Division

IF EARNINGS ARE FROM SALARIES OR WAGES, DO NOT USE THIS FORM

Period From:

Period To:

Legal Name:

FEIN/SSN Number:

Mailing Address:

Account ID:

DBA Name:

The Revenue Division and the IRS routinely share computer tapes and

Business Address:

audit results. Differences, other than those allowed under City ordinance,

will be identified and may result in an audit or further investigation.

For changes to name, address or FEIN/SSN, please contact us at or (816) 513-1135.

Business/physical address (if multiple locations, attach list)

DOLLARS

CENTS

1. Type of business:

2. "X" if nonresident business

3. KCMO Gross receipts only

* Partnership

(No. of partners: ___ )

(from Schedule C - line 1 or Schedule Y - 4B)

Corporation

4. Income from business or profession

(IF LO SS, ENTER 0) (from Schedule C, Y, Z)

Proprietorship

5. Other taxable earnings, not including salaries or wages

Fiduciary

(IF LO SS, ENTER 0) (ATTACH SCHEDULES)

6. Total taxable earnings (line 4 plus line 5)

K-1 Source Income

7. Tax due (1% of line 6)

8. Profits tax paid with extension form RD-111 and/or credit carried forward

(DUE O N O R BEFO RE FILING DATE)

* If Partnership is

9. Profits tax paid to other city, not to exceed line 7

passing taxable

(resident businesses only) (ATTACH EVIDENCE O F PAYM ENT)

income to partners,

10. Amount due (line 7 less lines 8 and 9, not less than 0)

enter 0 on line 4

11. Penalty (5% per month, not to exceed 25%)

12. Interest (1% per month, until tax is paid in full)

13. Total amount due (sum of lines 10, 11, and 12)

14. Overpayment to be credited (lines 8 + 9 less line 7)

15. Overpayment to be refunded (lines 8 + 9 less line 7)

Write your FEIN/SSN on check.

16. Amount paid

(DO NOT SEND CASH)

Make payable to City Treasurer.

Mail return to Revenue Division

/

/

17. "X" if amended

18. Date if closed

P.O. Box 843322, KCMO 64184-3322

M

M

D

D

Y

Y

Under penalties of perjury, I declare this return (and accompanying schedules) to be a true, correct, and complete accounting for the taxable year stated.

Yes

No

I authorize the Com missioner of Revenue or delegate to discuss my return and attachm ents with my preparer.

Taxpayer Signature

Print Name

Title

Date

Phone

Preparer's Signature (if other than taxpayer)

Print Name

Title

Date

Phone

Draft

1

1