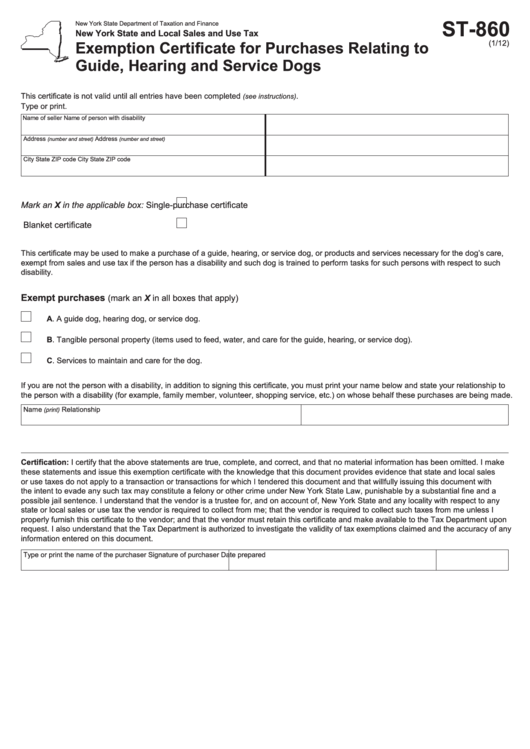

ST-860

New York State Department of Taxation and Finance

New York State and Local Sales and Use Tax

Exemption Certificate for Purchases Relating to

(1/12)

Guide, Hearing and Service Dogs

This certificate is not valid until all entries have been completed

.

(see instructions)

Type or print.

Name of seller

Name of person with disability

Address

Address

(number and street)

(number and street)

City

State

ZIP code

City

State

ZIP code

Mark an X in the applicable box:

Single-purchase certificate

Blanket certificate

This certificate may be used to make a purchase of a guide, hearing, or service dog, or products and services necessary for the dog’s care,

exempt from sales and use tax if the person has a disability and such dog is trained to perform tasks for such persons with respect to such

disability.

Exempt purchases

(mark an X in all boxes that apply)

A. A guide dog, hearing dog, or service dog.

B. Tangible personal property (items used to feed, water, and care for the guide, hearing, or service dog).

C. Services to maintain and care for the dog.

If you are not the person with a disability, in addition to signing this certificate, you must print your name below and state your relationship to

the person with a disability (for example, family member, volunteer, shopping service, etc.) on whose behalf these purchases are being made.

Name

Relationship

(print)

Certification: I certify that the above statements are true, complete, and correct, and that no material information has been omitted. I make

these statements and issue this exemption certificate with the knowledge that this document provides evidence that state and local sales

or use taxes do not apply to a transaction or transactions for which I tendered this document and that willfully issuing this document with

the intent to evade any such tax may constitute a felony or other crime under New York State Law, punishable by a substantial fine and a

possible jail sentence. I understand that the vendor is a trustee for, and on account of, New York State and any locality with respect to any

state or local sales or use tax the vendor is required to collect from me; that the vendor is required to collect such taxes from me unless I

properly furnish this certificate to the vendor; and that the vendor must retain this certificate and make available to the Tax Department upon

request. I also understand that the Tax Department is authorized to investigate the validity of tax exemptions claimed and the accuracy of any

information entered on this document.

Type or print the name of the purchaser

Signature of purchaser

Date prepared

1

1 2

2