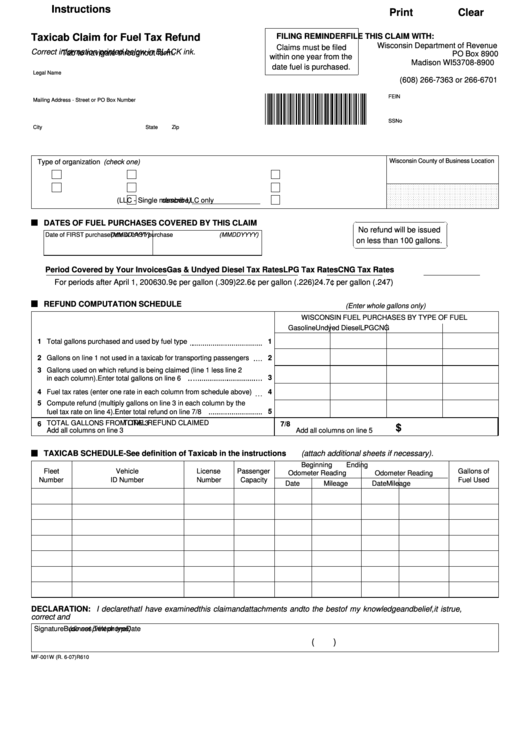

Instructions

Print

Clear

Taxicab Claim for Fuel Tax Refund

FILING REMINDER

FILE THIS CLAIM WITH:

Wisconsin Department of Revenue

Claims must be filed

Correct information printed below in BLACK ink.

Tab to navigate throughout form.

PO Box 8900

within one year from the

Madison WI 53708-8900

date fuel is purchased.

Legal Name

(608) 266-7363 or 266-6701

FEIN

Mailing Address - Street or PO Box Number

*X10107991*

SSNo

City

State

Zip

Wisconsin County of Business Location

Type of organization

(check one)

1.

Individual

3.

Wisconsin corporation

LLC - Taxed as partnership

2.

Partnership

4.

Out-of-state corporation

LLC - Taxed as corporation

5.

Other (

describe)

LLC - Single member LLC only

DATES OF FUEL PURCHASES COVERED BY THIS CLAIM

No refund will be issued

Date of FIRST purchase

(MMDDYYYY)

Date of LAST purchase

(MMDDYYYY)

on less than 100 gallons.

Period Covered by Your Invoices

Gas & Undyed Diesel Tax Rates

LPG Tax Rates

CNG Tax Rates

For periods after April 1, 2006

30.9¢ per gallon (.309)

22.6¢ per gallon (.226)

24.7¢ per gallon (.247)

REFUND COMPUTATION SCHEDULE

(Enter whole gallons only)

WISCONSIN FUEL PURCHASES BY TYPE OF FUEL

Gasoline

Undyed Diesel

LPG

CNG

1

Total gallons purchased and used by fuel type

1

2

Gallons on line 1 not used in a taxicab for transporting passengers

2

3

Gallons used on which refund is being claimed (line 1 less line 2

3

in each column). Enter total gallons on line 6

4

Fuel tax rates (enter one rate in each column from schedule above)

4

5

Compute refund (multiply gallons on line 3 in each column by the

5

fuel tax rate on line 4). Enter total refund on line 7/8

TOTAL GALLONS FROM LINE 3

TOTAL REFUND CLAIMED

6

7/8

$

Add all columns on line 3

Add all columns on line 5

TAXICAB SCHEDULE - See definition of Taxicab in the instructions

(attach additional sheets if necessary).

Beginning

Ending

Fleet

Vehicle

License

Passenger

Gallons of

Odometer Reading

Odometer Reading

Number

ID Number

Number

Capacity

Fuel Used

Date

Mileage

Date

Mileage

DECLARATION:

I declare that I have examined this claim and attachments and to the best of my knowledge and belief, it is true,

correct and complete. The fuel purchases on which this claim is based have been made within the last 12 months.

Signature

(do not print or type)

Business Telephone

Date

(

)

MF-001W (R. 6-07)

R610

1

1 2

2 3

3 4

4