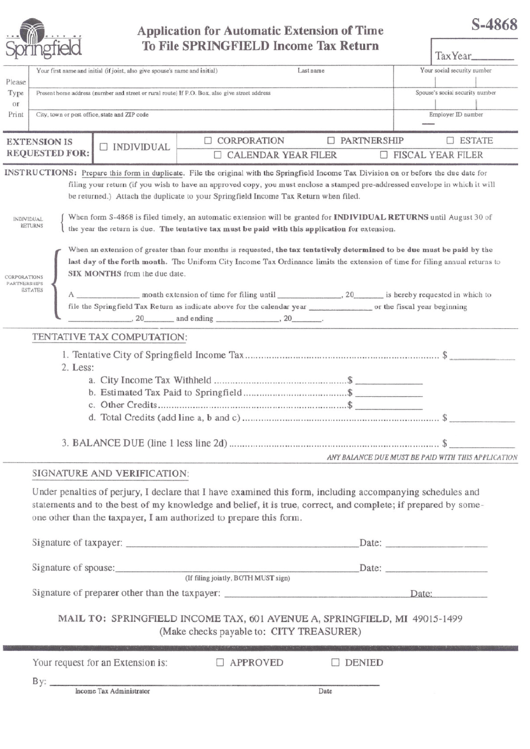

Form 8-4868 - Application For Automatic Extension Of Time To File Springfield Income Tax Return

ADVERTISEMENT

s::-'

~~(i~\". ... ..

Spnflgfield

Application for Automatic Extension of Time

To File SPRINGFIELD Income Tax Return

8-4868

I

TaxYear,

INSTRUCTIONS:

Prepare this form in duplicate. File the original with the Springfield Income Tax Division on or before the due date for

filing your return (if you wish to have an approved copy, )::oumust enclose a stamped pre-addressed envelope in which it will

be returned.) Attach the duplicate to your Springfield Income Tax Return when filed.

tNDtVtDUAL

RETU RNS

{

When form S-4868 is filed timely, an automatic extension will be granted for INDIVIDUAL

RETURNS

until August 30 of

the year the return is due. The tentative

tax must be paid with this application

for extension.

CORPORATIONS

PARTNERSHIPS

EST A 'ITS

When an extension of greater than four months is requested,

the tax tentatively

determined

to be due must be paid by the

last day of the forth month.

The Uniform City Income Tax Ordinance limits the extension of time for filing annual returns to

SIX MONTHS

from the due date.

A

month extension of time for filing until

file the Springfield

Tax Return as indicate above for the calendar year

,W

and~ili~

,~

,20

is hereby requested in which to

or the fiscal year beginning

TENTATIVE TAX COMPUTATION:

1.

Tentative City of Springfield Income Tax

$

2. Less:

a. City Income Tax Withheld

$

b. Estimated Tax Paid to Springfield

$

c. Other Credits

$

d. Total Credits (add line a, b and c)

"

$

3. BALANCE DUE (line 1 less line 2d)

""""""""""""""""""""""""""""""""""""""'"

$

ANY BALANCEDUE MUST BE PAiD WITH THISAPPUCATION

SIGNATURE AND VERIFICATION:

Under penalties of perjury, I declare that I have examined this form, including accompanying schedules and

statements and to the best of my knowledge and belief, it is true, correct, and complete; if prepared by some-

one other than the taxpayer, I am authorized to prepare this form.

Signature of taxpayer:

Date:

Signature of spouse:

Date:

(If filing jointly, BOlli

MUST

sign)

Signature of preparer other than the taxpayer:

I2ak

MAIL TO: SPRINGFIELD INCOME TAX, 601 AVENUE A, SPRINGFIELD, MI 49015-1499

(Make checks payable to: CITY TREASURER)

Yourrequestfor an Extensionis:

D APPROVED

D DENIED

By:

Income Tax Administrator

Date

Your first name and initial (ifjoint, also give spouse's name and initial)

Lastname

Your social security number

Please

I

I

Type

Present home address (number and street or rural route) If P,O, Box, also give street address

Spouse's social security number

or

I

!

Print

City, town or post office, state and ZIP code

Employer ID number

-

EXTENSION IS

0 INDIVIDUAL

0 CORPORATION

0 PARTNERSHIP

0 ESTATE

REQUESTED FOR:

0 CALENDAR YEAR FILER

0 FISCAL YEAR FILER

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1