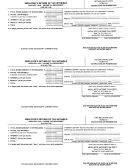

Form W-1 - Employer'S Return Of Tax Withheld Page 3

ADVERTISEMENT

FORM W-3 INSTRUCTIONS

The W-3 must be filed with City of West Carrollton Tax Administrator on or before February 28th of the following year. An extension may be granted if

a proper written request is received by the February 28th due date. W-2 copies of the employees that have West Carrollton tax withheld must be

attached to the W-3 in alphabetical order or social security number order, with a summary total of the West Carrollton tax withheld as well as a

reconciliation between tax withheld and tax paid. If a difference greater than $2.00 exists, the balance due should be paid with this return. A refund or

credit request greater than $2.00 should be supported with a proper written explanation. In lieu of W-2(s), we will accept computer printouts but they

must contain all pertinent information that is on the W-2 such as employee address, social security number, and gross city taxable earnings.

Notify the Income Tax Department promptly of any change in ownership, name, federal identification number, and/or address.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4