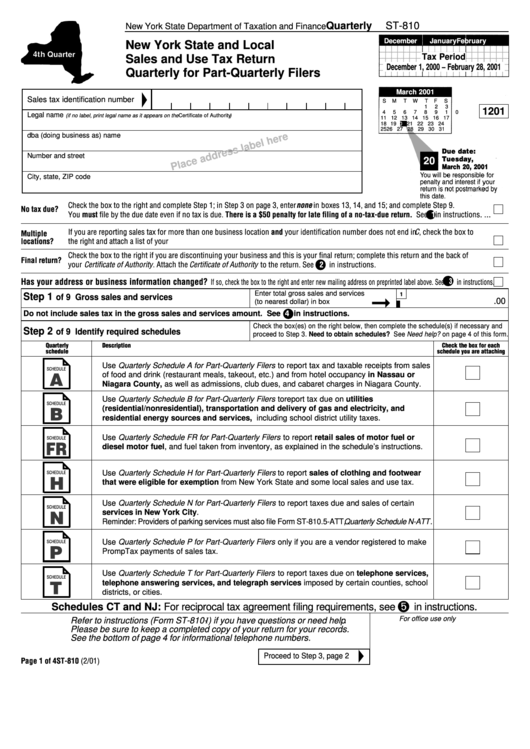

Form St-810 - New York State And Local Sales And Use Tax Return Quarterly For Part-Quarterly Filers - 2001

ADVERTISEMENT

Quarterly

ST-810

New York State Department of Taxation and Finance

December

January

February

New York State and Local

Tax Period

Sales and Use Tax Return

December 1, 2000 – February 28, 2001

Quarterly for Part-Quarterly Filers

March 2001

Sales tax identification number

S

M

T

W

T

F

S

1

2

3

1201

4

5

6

7

8

9 10

Legal name

(if no label, print legal name as it appears on the Certificate of Authority )

11 12 13 14 15 16 17

18 19

20

21 22 23 24

25 26 27 28 29 30 31

dba (doing business as) name

Due date:

Number and street

Tuesday,

20

March 20, 2001

City, state, ZIP code

Check the box to the right and complete Step 1; in Step 3 on page 3, enter none in boxes 13, 14, and 15; and complete Step 9.

No tax due?

You must file by the due date even if no tax is due. There is a $50 penalty for late filing of a no-tax-due return. See

1

in instructions. ...

If you are reporting sales tax for more than one business location and your identification number does not end in C , check the box to

Multiple

locations?

the right and attach a list of your locations. ....................................................................................................................................................

Check the box to the right if you are discontinuing your business and this is your final return; complete this return and the back of

Final return?

your Certificate of Authority . Attach the Certificate of Authority to the return. See

2

in instructions. .........................................................

Has your address or business information changed?

3

If so, check the box to the right and enter new mailing address on preprinted label above. See

in instructions.

Enter total gross sales and services

1

Step 1

of 9 Gross sales and services

.00

(to nearest dollar) in box 1 .................

Do not include sales tax in the gross sales and services amount. See

4

in instructions.

Check the box(es) on the right below, then complete the schedule(s) if necessary and

Step 2

of 9 Identify required schedules

proceed to Step 3. Need to obtain schedules? See Need help? on page 4 of this form.

Quarterly

Description

Check the box for each

schedule

schedule you are attaching

Use Quarterly Schedule A for Part-Quarterly Filers to report tax and taxable receipts from sales

SCHEDULE

of food and drink (restaurant meals, takeout, etc.) and from hotel occupancy in Nassau or

A

Niagara County, as well as admissions, club dues, and cabaret charges in Niagara County.

Use Quarterly Schedule B for Part-Quarterly Filers to report tax due on utilities

SCHEDULE

(residential/nonresidential), transportation and delivery of gas and electricity, and

B

residential energy sources and services, including school district utility taxes.

Use Quarterly Schedule FR for Part-Quarterly Filers to report retail sales of motor fuel or

SCHEDULE

FR

diesel motor fuel, and fuel taken from inventory, as explained in the schedule’s instructions.

Use Quarterly Schedule H for Part-Quarterly Filers to report sales of clothing and footwear

SCHEDULE

H

that were eligible for exemption from New York State and some local sales and use tax.

Use Quarterly Schedule N for Part-Quarterly Filers to report taxes due and sales of certain

SCHEDULE

services in New York City.

N

Reminder: Providers of parking services must also file Form ST-810.5-ATT, Quarterly Schedule N-ATT .

Use Quarterly Schedule P for Part-Quarterly Filers only if you are a vendor registered to make

SCHEDULE

P

PrompTax payments of sales tax.

Use Quarterly Schedule T for Part-Quarterly Filers to report taxes due on telephone services,

SCHEDULE

telephone answering services, and telegraph services imposed by certain counties, school

T

districts, or cities.

Schedules CT and NJ: For reciprocal tax agreement filing requirements, see

in instructions.

For office use only

Refer to instructions (Form ST-810- I ) if you have questions or need help .

Please be sure to keep a completed copy of your return for your records.

See the bottom of page 4 for informational telephone numbers.

Proceed to Step 3, page 2

Page 1 of 4 ST-810 (2/01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4