Reset Form

Print Form

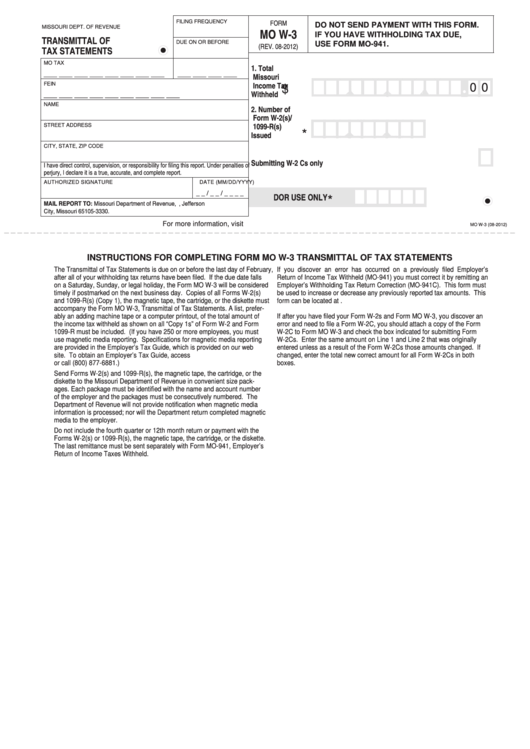

FILING FREQUENCY

FORM

DO NOT SEND PAYMENT WITH THIS FORM.

MISSOURI DEPT. OF REVENUE

MO W-3

IF YOU HAVE WITHHOLDING TAX DUE,

TRANSMITTAL OF

DUE ON OR BEFORE

USE FORM MO-941.

(REV. 08-2012)

TAX STATEMENTS

MO TAX I.D. NUMBER

TAX YEAR

1. Total

___ ___ ___ ___ ___ ___ ___ ___

___ ___ ___ ___

Missouri

Income Tax

FEIN

0 0

$

•

Withheld ......

___ ___ ___ ___ ___ ___ ___ ___ ___

NAME

2. Number of

Form W-2(s)/

1099-R(s)

STREET ADDRESS

*

Issued ..........

CITY, STATE, ZIP CODE

Submitting W-2 Cs only ....................................................................................

I have direct control, supervision, or responsibility for filing this report. Under penalties of

perjury, I declare it is a true, accurate, and complete report.

AUTHORIZED SIGNATURE

DATE (MM/DD/YYYY)

_ _ / _ _ / _ _ _ _

DOR USE ONLY

*

MAIL REPORT TO: Missouri Department of Revenue, P.O. Box 3330, Jefferson

City, Missouri 65105-3330.

For more information, visit

MO W-3 (08-2012)

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

INSTRUCTIONS FOR COMPLETING FORM MO W-3 TRANSMITTAL OF TAX STATEMENTS

The Transmittal of Tax Statements is due on or before the last day of February,

If you discover an error has occurred on a previously filed Employer’s

after all of your withholding tax returns have been filed. If the due date falls

Return of Income Tax Withheld (MO-941) you must correct it by remitting an

on a Saturday, Sunday, or legal holiday, the Form MO W-3 will be considered

Employer’s Withholding Tax Return Correction (MO-941C). This form must

timely if postmarked on the next business day. Copies of all Forms W-2(s)

be used to increase or decrease any previously reported tax amounts. This

and 1099-R(s) (Copy 1), the magnetic tape, the cartridge, or the diskette must

form can be located at

accompany the Form MO W-3, Transmittal of Tax Statements. A list, prefer-

ably an adding machine tape or a computer printout, of the total amount of

If after you have filed your Form W-2s and Form MO W-3, you discover an

the income tax withheld as shown on all “Copy 1s” of Form W-2 and Form

error and need to file a Form W-2C, you should attach a copy of the Form

1099-R must be included. (If you have 250 or more employees, you must

W-2C to Form MO W-3 and check the box indicated for submitting Form

use magnetic media reporting. Specifications for magnetic media reporting

W-2Cs. Enter the same amount on Line 1 and Line 2 that was originally

are provided in the Employer’s Tax Guide, which is provided on our web

entered unless as a result of the Form W-2Cs those amounts changed. If

site. To obtain an Employer’s Tax Guide, access

changed, enter the total new correct amount for all Form W-2Cs in both

or call (800) 877-6881.)

boxes.

Send Forms W-2(s) and 1099-R(s), the magnetic tape, the cartridge, or the

diskette to the Missouri Department of Revenue in convenient size pack-

ages. Each package must be identified with the name and account number

of the employer and the packages must be consecutively numbered. The

Department of Revenue will not provide notification when magnetic media

information is processed; nor will the Department return completed magnetic

media to the employer.

Do not include the fourth quarter or 12th month return or payment with the

Forms W-2(s) or 1099-R(s), the magnetic tape, the cartridge, or the diskette.

The last remittance must be sent separately with Form MO-941, Employer’s

Return of Income Taxes Withheld.

1

1