Sales Tax And Transient Occupancy Tax Return Form - City Of Thorne Bay - 2015

ADVERTISEMENT

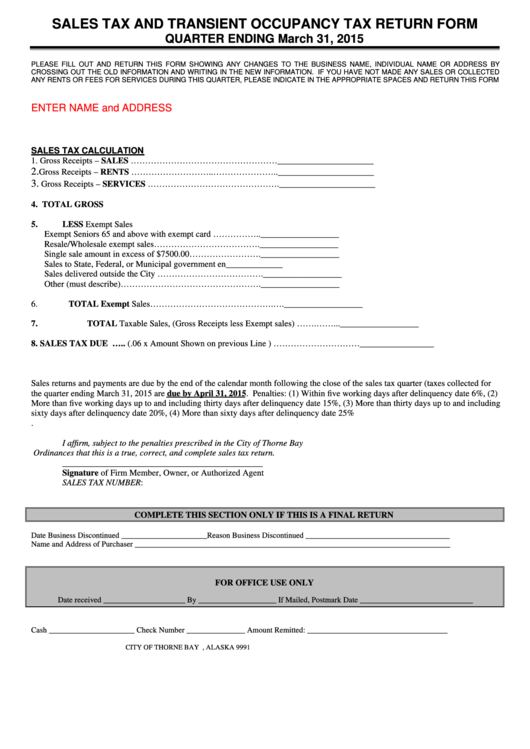

SALES TAX AND TRANSIENT OCCUPANCY TAX RETURN FORM

QUARTER ENDING March 31, 2015

PLEASE FILL OUT AND RETURN THIS FORM SHOWING ANY CHANGES TO THE BUSINESS NAME, INDIVIDUAL NAME OR ADDRESS BY

CROSSING OUT THE OLD INFORMATION AND WRITING IN THE NEW INFORMATION. IF YOU HAVE NOT MADE ANY SALES OR COLLECTED

ANY RENTS OR FEES FOR SERVICES DURING THIS QUARTER, PLEASE INDICATE IN THE APPROPRIATE SPACES AND RETURN THIS FORM

ENTER NAME and ADDRESS

SALES TAX CALCULATION

1.

Gross Receipts – SALES ……………………………………………______________________

2.

Gross Receipts – RENTS ………………………..…………………..______________________

3.

Gross Receipts – SERVICES ……………………………………….______________________

4.

TOTAL GROSS RECEIPTS.............................................................._____________________

5.

LESS Exempt Sales

Exempt Seniors 65 and above with exempt card ……………..__________________

Resale/Wholesale exempt sales……………………………….__________________

Single sale amount in excess of $7500.00…………………….__________________

Sales to State, Federal, or Municipal government entity...........__________________

Sales delivered outside the City ……………………………….__________________

Other (must describe)………………………………………….__________________

6.

TOTAL Exempt Sales…………………………………….….__________________

7.

TOTAL Taxable Sales, (Gross Receipts less Exempt sales) …….……...__________________

8.

SALES TAX DUE ….. (.06 x Amount Shown on previous Line ) …………………………_________________

Sales returns and payments are due by the end of the calendar month following the close of the sales tax quarter (taxes collected for

the quarter ending March 31, 2015 are due by April 31, 2015. Penalties: (1) Within five working days after delinquency date 6%, (2)

More than five working days up to and including thirty days after delinquency date 15%, (3) More than thirty days up to and including

sixty days after delinquency date 20%, (4) More than sixty days after delinquency date 25%

.

I affirm, subject to the penalties prescribed in the City of Thorne Bay

Ordinances that this is a true, correct, and complete sales tax return.

______________________________________________

Signature of Firm Member, Owner, or Authorized Agent

SALES TAX NUMBER:

COMPLETE THIS SECTION ONLY IF THIS IS A FINAL RETURN

Date Business Discontinued ______________________Reason Business Discontinued _____________________________________

Name and Address of Purchaser _________________________________________________________________________________

FOR OFFICE USE ONLY

Date received _____________________ By ____________________ If Mailed, Postmark Date _____________________________

Cash ______________________ Check Number _______________ Amount Remitted: ____________________________________

CITY OF THORNE BAY

P.O. BOX 19110

THORNE BAY, ALASKA 9991

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3