Form 10a - Regional Income Tax Agency Application For Municipal Income Tax Refund Page 2

ADVERTISEMENT

2

Page

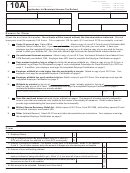

Form 10-A

Employee’s SSN

Name of employee shown on page 1

Tax Year of Claim

Employer Certification – Part 1

A.

Refund/Credit Calculation

A 1 Total Wages from employee’s W-2 Form

A-1

2 Enter name of municipality for which tax was withheld A-2

3 Amount of municipal tax withheld to the municipality indicated on line A-2

A-3

4 List the complete address of the municipality where

the employee physically performed the work or

Work location street address

services. If the employee did not work within the

limits of a municipality, skip lines A-5, A-6 and A-7,

and enter -0- on line A-8

A-4

City, State, Zip Code

5 Enter the amount of municipal taxable wages earned in the municipality

A-5

indicated on line A-4

6 Enter the tax rate of the municipality indicated on line A-4

A-6

7 Tax due to municipality where employee physically worked. Multiply line A-5

by the tax rate on line A-6

A-7

8 If the municipality indicated on line A-4 is a RITA municipality, enter the amount from line A-7;

otherwise enter -0-

A-8

9 Amount of over-withheld tax to be refunded or credited. Subtract line A-8 from line A-3.

A-9

Amounts $10 or less will not be refunded. Enter total on Page 1, line 4.

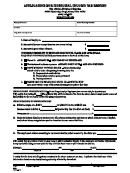

B. Employee’s Home Address

According to our records, this employee’s home address for the period covered by this claim was:

Employee’s Home Street Address

City

State

Zip

C. Employee’s Employment Dates

If the employee is still employed, enter “n/a” as the date of separation.

Date of Hire

Date of Separation

Employer Certification – Part 2

D. Employer Representative’s Explanation of Reason for Refund and Signature

The undersigned employer representative states that during the year referenced above the employer withheld municipal income tax from the above

named employee in excess of the employee’s liability as calculated above; that the above referenced employee was employed during the period

referenced above; that the employer has examined this claim for refund in its entirety including any accompanying schedules and statements; and that

the employer representative can attest that the information reported on this claim is true and accurate.

In addition, the undersigned employer representative verifies that no portion of the over-withheld tax has been or will be refunded directly to the

employee by the employer, and that no adjustments to the employer’s withholding account related to this claim have been or will be made.

Representative’s Signature

Representative’s Title

Representative’s Phone Number

Date

Print Representative’s Name

Print Representative’s Title

Explanation of Reason for Refund

(example–“taxpayer works from home 4 days”)

Employee’s Signature

Under penalties of perjury, I declare that I have examined this claim, and to the best of my knowledge and belief, it is true, correct and complete. I

understand that this information may be released to the tax administrator of the resident or workplace municipality and the Internal Revenue

Service. I further understand that if this refund changes my RITA residence tax, an amended return must be filed before the refund will be issued. I also

understand that if I have an unpaid balance due, this refund will be applied to that balance due.

Employee’s Signature

Employee’s Daytime Phone

Employee’s Evening Phone

Date

To avoid delays:

Mail this form along with the required documents

Mail with required documentation to:

indicated under your “Reason for Claim” on page

Regional Income Tax Agency

1 to the address shown at right; and

PO Box 470638

If filing Form 37, attach the 10A to the completed

Broadview Hts. OH 44147-0638

return and mail them together.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3