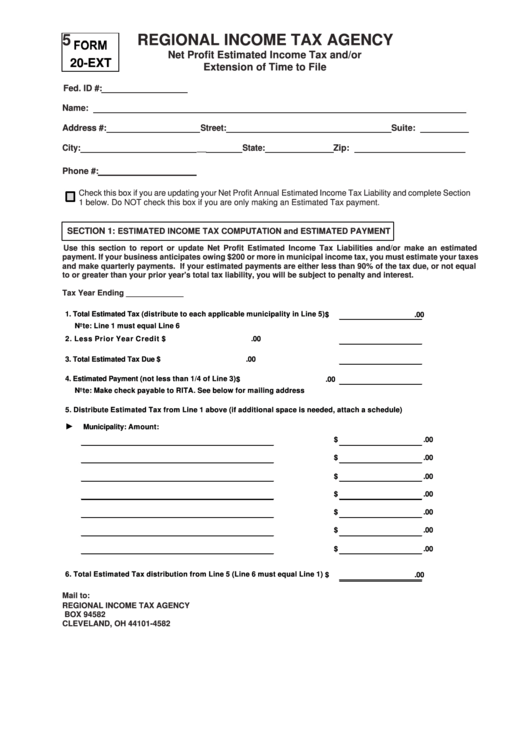

Form 20-Ext - Net Profit Estimated Income Tax And/or Extension Of Time To File

ADVERTISEMENT

5

REGIONAL INCOME TAX AGENCY

Net Profit Estimated Income Tax and/or

20-EXT

Extension of Time to File

Fed. ID #:

Name:

Address #:

Street:

Suite:

City:

__

State:

Zip:

Phone #:

Check this box if you are updating your Net Profit Annual Estimated Income Tax Liability and complete Section

1 below. Do NOT check this box if you are only making an Estimated Tax payment.

SECTION 1: ESTIMATED INCOME TAX COMPUTATION and ESTIMATED PAYMENT

Use this section to report or update Net Profit Estimated Income Tax Liabilities and/or make an estimated

payment. If your business anticipates owing $200 or more in municipal income tax, you must estimate your taxes

and make quarterly payments. If your estimated payments are either less than 90% of the tax due, or not equal

to or greater than your prior year's total tax liability, you will be subject to penalty and interest.

Tax Year Ending _____________

1. Total Estim ated Tax (distribute to each applicable m unicipality in Line 5)

$

.00

Note: Line 1 m ust equal Line 6

2. Less Prior Year Credit

$

.00

3. Total Estim ated Tax Due

$

.00

4. Estim ated Paym ent (not less than 1/4 of Line 3)

$

.00

Note: Make check payable to RITA. See below for m ailing address

5. Distribute Estim ated Tax from Line 1 above (if additional space is needed, attach a schedule)

►

Municipality:

Am ount:

$

.00

$

.00

$

.00

$

.00

$

.00

$

.00

$

.00

6. Total Estim ated Tax distribution from Line 5 (Line 6 m ust equal Line 1)

$

.00

Mail to:

REGIONAL INCOME TAX AGENCY

P.O. BOX 94582

CLEVELAND, OH 44101-4582

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2