Retail Sales Tax Exemption Certificate To Reduce Agricultural Burning Form Arril 2000

ADVERTISEMENT

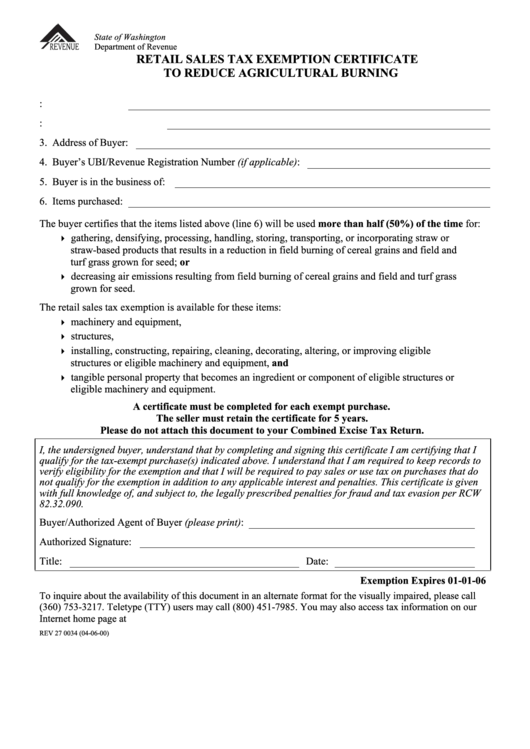

State of Washington

Department of Revenue

RETAIL SALES TAX EXEMPTION CERTIFICATE

TO REDUCE AGRICULTURAL BURNING

1. Name of Seller:

2. Name of Buyer/Business:

3. Address of Buyer:

4. Buyer’s UBI/Revenue Registration Number (if applicable):

5. Buyer is in the business of:

6. Items purchased:

The buyer certifies that the items listed above (line 6) will be used more than half (50%) of the time for:

gathering, densifying, processing, handling, storing, transporting, or incorporating straw or

straw-based products that results in a reduction in field burning of cereal grains and field and

turf grass grown for seed; or

decreasing air emissions resulting from field burning of cereal grains and field and turf grass

grown for seed.

The retail sales tax exemption is available for these items:

machinery and equipment,

structures,

installing, constructing, repairing, cleaning, decorating, altering, or improving eligible

structures or eligible machinery and equipment, and

tangible personal property that becomes an ingredient or component of eligible structures or

eligible machinery and equipment.

A certificate must be completed for each exempt purchase.

The seller must retain the certificate for 5 years.

Please do not attach this document to your Combined Excise Tax Return.

I, the undersigned buyer, understand that by completing and signing this certificate I am certifying that I

qualify for the tax-exempt purchase(s) indicated above. I understand that I am required to keep records to

verify eligibility for the exemption and that I will be required to pay sales or use tax on purchases that do

not qualify for the exemption in addition to any applicable interest and penalties. This certificate is given

with full knowledge of, and subject to, the legally prescribed penalties for fraud and tax evasion per RCW

82.32.090.

Buyer/Authorized Agent of Buyer (please print):

Authorized Signature:

Title:

Date:

Exemption Expires 01-01-06

To inquire about the availability of this document in an alternate format for the visually impaired, please call

(360) 753-3217. Teletype (TTY) users may call (800) 451-7985. You may also access tax information on our

Internet home page at

REV 27 0034 (04-06-00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1