Application For Extension Of Time To File Muskegon Heights Income Tax Return Form

ADVERTISEMENT

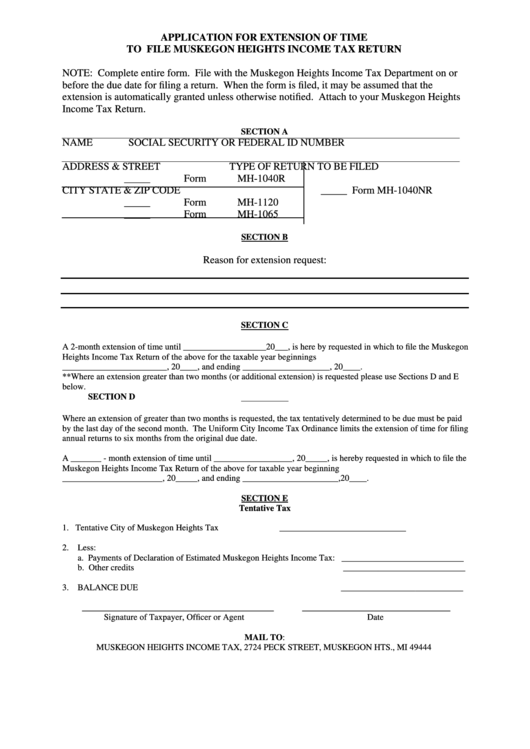

APPLICATION FOR EXTENSION OF TIME

TO FILE MUSKEGON HEIGHTS INCOME TAX RETURN

NOTE: Complete entire form. File with the Muskegon Heights Income Tax Department on or

before the due date for filing a return. When the form is filed, it may be assumed that the

extension is automatically granted unless otherwise notified. Attach to your Muskegon Heights

Income Tax Return.

SECTION A

NAME

SOCIAL SECURITY OR FEDERAL ID NUMBER

ADDRESS & STREET

TYPE OF RETURN TO BE FILED

_____ Form MH-1040R

CITY STATE & ZIP CODE

_____ Form MH-1040NR

_____ Form MH-1120

_____ Form MH-1065

SECTION B

Reason for extension request:

SECTION C

A 2-month extension of time until ___________________20___, is here by requested in which to file the Muskegon

Heights Income Tax Return of the above for the taxable year beginnings

________________________, 20____, and ending ____________________, 20____.

**Where an extension greater than two months (or additional extension) is requested please use Sections D and E

below.

SECTION D

Where an extension of greater than two months is requested, the tax tentatively determined to be due must be paid

by the last day of the second month. The Uniform City Income Tax Ordinance limits the extension of time for filing

annual returns to six months from the original due date.

A _______ - month extension of time until __________________, 20_____, is hereby requested in which to file the

Muskegon Heights Income Tax Return of the above for taxable year beginning

_______________________, 20_____, and ending ______________________,20____.

SECTION E

Tentative Tax

1. Tentative City of Muskegon Heights Tax

_____________________________

2. Less:

a. Payments of Declaration of Estimated Muskegon Heights Income Tax: ____________________________

b. Other credits

____________________________

3. BALANCE DUE

____________________________

____________________________________________

__________________________________

Signature of Taxpayer, Officer or Agent

Date

MAIL TO:

MUSKEGON HEIGHTS INCOME TAX, 2724 PECK STREET, MUSKEGON HTS., MI 49444

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1