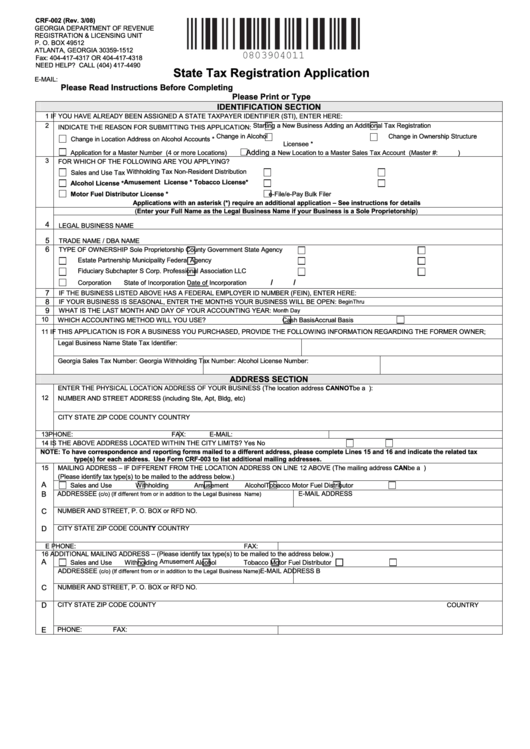

CRF-002 (Rev. 3/08)

Print

Clear

GEORGIA DEPARTMENT OF REVENUE

REGISTRATION & LICENSING UNIT

P. O. BOX 49512

ATLANTA, GEORGIA 30359-1512

Fax: 404-417-4317 OR 404-417-4318

NEED HELP? CALL (404) 417-4490

State Tax Registration Application

E-MAIL: TSD-sales-tax-lic@dor.ga.gov

Please Read Instructions Before Completing

TSD-withholding-lic@dor.ga.gov

Please Print or Type

IDENTIFICATION SECTION

1

IF YOU HAVE ALREADY BEEN ASSIGNED A STATE TAXPAYER IDENTIFIER (STI), ENTER HERE:

2

Starting a New Business

Adding an Additional Tax Registration

INDICATE THE REASON FOR SUBMITTING THIS APPLICATION:

Change in Alcohol

Change in Ownership Structure

Change in Location Address on Alcohol Accounts *

Licensee *

Adding a

Application for a Master Number (4 or more Locations)

New Location to a Master Sales Tax Account (Master #:

)

3

FOR WHICH OF THE FOLLOWING ARE YOU APPLYING?

Withholding Tax

Non-Resident Distribution

Sales and Use Tax

Amusement License *

Tobacco License*

Alcohol License *

Motor Fuel Distributor License *

e-File/e-Pay Bulk Filer

Applications with an asterisk (*) require an additional application – See instructions for details

(Enter your Full Name as the Legal Business Name if your Business is a Sole Proprietorship)

4

LEGAL BUSINESS NAME

5

TRADE NAME / DBA NAME

6

TYPE OF OWNERSHIP

Sole Proprietorship

County Government

State Agency

Estate

Partnership

Municipality

Federal Agency

Fiduciary

Subchapter S Corp.

Professional Association

LLC

/

/

Corporation

State of Incorporation

Date of Incorporation

7

IF THE BUSINESS LISTED ABOVE HAS A FEDERAL EMPLOYER ID NUMBER (FEIN), ENTER HERE:

8

IF YOUR BUSINESS IS SEASONAL, ENTER THE MONTHS YOUR BUSINESS WILL BE OPEN:

Begin

Thru

9

WHAT IS THE LAST MONTH AND DAY OF YOUR ACCOUNTING YEAR:

Month

Day

10

WHICH ACCOUNTING METHOD WILL YOU USE?

Cash Basis

Accrual Basis

11

IF THIS APPLICATION IS FOR A BUSINESS YOU PURCHASED, PROVIDE THE FOLLOWING INFORMATION REGARDING THE FORMER OWNER;

Legal Business Name

State Tax Identifier:

Georgia Sales Tax Number:

Georgia Withholding Tax Number:

Alcohol License Number:

ADDRESS SECTION

ENTER THE PHYSICAL LOCATION ADDRESS OF YOUR BUSINESS (The location address CANNOT be a P.O. Box):

12

NUMBER AND STREET ADDRESS (including Ste, Apt, Bldg, etc)

CITY

STATE

ZIP CODE

COUNTY

COUNTRY

13

PHONE:

FAX:

E-MAIL:

14

IS THE ABOVE ADDRESS LOCATED WITHIN THE CITY LIMITS?

Yes

No

NOTE:

To have correspondence and reporting forms mailed to a different address, please complete Lines 15 and 16 and indicate the related tax

type(s) for each address. Use Form CRF-003 to list additional mailing addresses.

15

MAILING ADDRESS – IF DIFFERENT FROM THE LOCATION ADDRESS ON LINE 12 ABOVE (The mailing address CAN be a P.O. Box)

(Please identify tax type(s) to be mailed to the address below.)

A

Sales and Use

Withholding

Amusement

Alcohol

Tobacco

Motor Fuel Distributor

B

ADDRESSEE

E-MAIL ADDRESS

(c/o) (If different from or in addition to the Legal Business Name)

C

NUMBER AND STREET, P. O. BOX or RFD NO.

D

CITY

STATE

ZIP CODE

COUNTY

COUNTRY

E

PHONE:

FAX:

16

ADDITIONAL MAILING ADDRESS – (Please identify tax type(s) to be mailed to the address below.)

A

Amusement

Sales and Use

Withholding

Alcohol

Tobacco

Motor Fuel Distributor

B

ADDRESSEE

E-MAIL ADDRESS

(c/o) (If different from or in addition to the Legal Business Name)

C

NUMBER AND STREET, P. O. BOX or RFD NO.

D

CITY

STATE

ZIP CODE

COUNTY

COUNTRY

E

PHONE:

FAX:

1

1 2

2