__ __ __ __ __ __

A

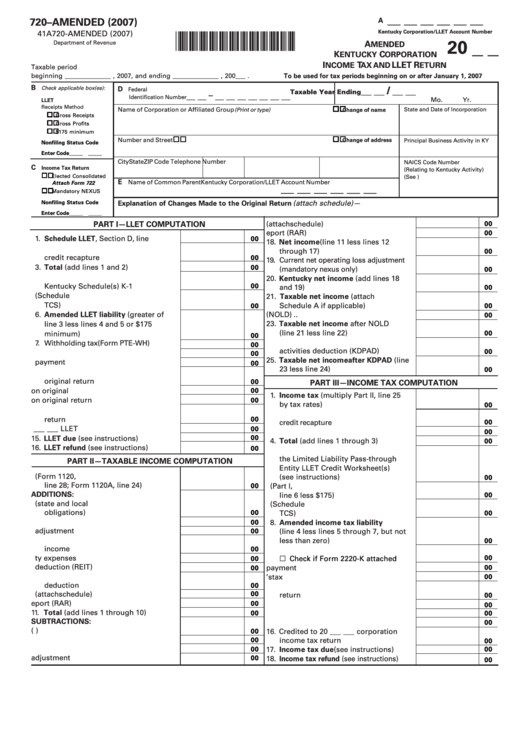

720–AMENDED (2007)

Kentucky Corporation/LLET Account Number

41A720-AMENDED (2007)

*0700020276*

Department of Revenue

A

20 _ _

MENDED

K

C

ENTUCKY

ORPORATION

I

T

LLET R

NCOME

AX AND

ETURN

Taxable period

beginning ______________ , 2007, and ending ______________ , 200___ .

To be used for tax periods beginning on or after January 1, 2007

B

Check applicable box(es):

D

__ __ / __ __

Federal

Taxable Year Ending

__ __ – __ __ __ __ __ __ __

Identification Number

Mo.

Yr.

LLET

Receipts Method

Name of Corporation or Affiliated Group

(Print or type)

Change of name

State and Date of Incorporation

Gross Receipts

Gross Profits

$175 minimum

Number and Street

Change of address

Principal Business Activity in KY

Nonfiling Status Code

Enter Code

_____ _____

City

State

ZIP Code

Telephone Number

NAICS Code Number

C

Income Tax Return

(Relating to Kentucky Activity)

Elected Consolidated

(See )

E

Name of Common Parent

Kentucky Corporation/LLET Account Number

Attach Form 722

__ __ __ __ __ __

Mandatory NEXUS

(attach schedule)—

Nonfiling Status Code

Explanation of Changes Made to the Original Return

Enter Code

_____ _____

PART I—LLET COMPUTATION

16. Other (attach schedule) .........................

00

17. Revenue Agents Report (RAR) ..............

00

1. Schedule LLET, Section D, line 1 ..........

00

18. Net income (line 11 less lines 12

2. Recycling/composting equipment tax

through 17) .............................................

00

credit recapture ......................................

00

19. Current net operating loss adjustment

3. Total (add lines 1 and 2) ........................

00

(mandatory nexus only) ..........................

00

4. Nonrefundable LLET credit from

20. Kentucky net income (add lines 18

Kentucky Schedule(s) K-1 ......................

00

and 19) ....................................................

00

5. Nonrefundable tax credits (Schedule

21. Taxable net income (attach

TCS) ........................................................

Schedule A if applicable) .......................

00

00

6. Amended LLET liability (greater of

22. Net operating loss deduction (NOLD) ..

00

23. Taxable net income after NOLD

line 3 less lines 4 and 5 or $175

(line 21 less line 22) ...............................

00

minimum) ...............................................

00

24. Kentucky domestic production

7. Withholding tax (Form PTE-WH) ...........

00

activities deduction (KDPAD) ................

00

8. Estimated tax payments .......................

00

25. Taxable net income after KDPAD (line

9. Extension payment ................................

00

23 less line 24) .......................................

00

10. Income tax overpayment from

original return ........................................

00

PART III—INCOME TAX COMPUTATION

11. LLET paid on original return .................

00

1. Income tax (multiply Part II, line 25

12. LLET refund on original return .............

00

by tax rates) ............................................

00

13. Credited to income tax from original

2. Recycling/composting equipment tax

return ......................................................

00

00

credit recapture .......................................

14. Credited to 20 ___ ___ LLET ..................

00

3. Tax installment on LIFO recapture .......

00

00

15. LLET due (see instructions) ..................

4. Total (add lines 1 through 3) .................

00

16. LLET refund (see instructions) ..............

00

5. Nonrefundable LLET credit from

the Limited Liability Pass-through

PART II—TAXABLE INCOME COMPUTATION

Entity LLET Credit Worksheet(s)

1. Federal taxable income (Form 1120,

(see instructions) ...................................

00

line 28; Form 1120A, line 24) .................

00

6. Nonrefundable LLET credit (Part I,

ADDITIONS:

00

line 6 less $175) ......................................

2. Interest income (state and local

7. Nonrefundable tax credits (Schedule

obligations) ............................................

00

00

TCS) ........................................................

3. State taxes based on net/gross income

00

8. Amended income tax liability

4. Depreciation adjustment .......................

00

(line 4 less lines 5 through 7, but not

5. Deductions attributable to nontaxable

less than zero) ........................................

00

income ....................................................

00

9. Estimated tax payments

6. Related party expenses .........................

00

00

Check if Form 2220-K attached .......

7. Dividend paid deduction (REIT) ............

10. Extension payment ................................

00

00

8. Domestic production activities

11. Prior year’s tax credit ............................

00

deduction ................................................

00

12. LLET overpayment from original

9. Other (attach schedule) .........................

00

return ......................................................

00

10. Revenue Agents Report (RAR) ..............

00

13. Corporation tax paid on original return ....

00

11. Total (add lines 1 through 10) ...............

00

14. Corporation tax refund on original return

00

SUBTRACTIONS:

15. Credited to LLET from original return .....

00

12. Interest income (U.S. obligations) .......

00

16. Credited to 20 ___ ___ corporation

13. Dividend income ....................................

00

income tax return ..................................

00

14. Federal work opportunity credit ...........

00

17. Income tax due (see instructions) ........

00

15. Depreciation adjustment .......................

00

18. Income tax refund (see instructions) .......

00

1

1 2

2