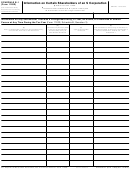

Schedule B-1 (Form 1065) - Information On Partners Owning 50% Or More Of The Partnership - 2011

ADVERTISEMENT

2

Schedule B-1 (Form 1065) (Rev. 12-2011)

Page

General Instructions

interest of 70% in the profit, loss, or capital of Partnership C.

Therefore, Corporation A owns, directly or indirectly, an

interest of 50% in the profit, loss, or capital of Partnership C

Section references are to the Internal Revenue Code unless

(15% directly and 35% indirectly through Partnership B). On

otherwise noted.

Partnership C’s Form 1065, it must answer “Yes” to question

Purpose of Form

3a of Schedule B. Partnership C must also complete Part I of

Schedule B-1. In Part I, Partnership C must identify Corporation

Use Schedule B-1 (Form 1065) to provide the information

A, which includes entering “50%” in column (v) (its maximum

applicable to certain entities, individuals, and estates that own,

percentage owned). It also must identify Partnership B, and

directly or indirectly, an interest of 50% or more in the profit,

enter “70%” in column (v).

loss, or capital of the partnership.

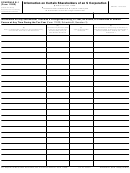

Part II

Who Must File

Complete Part II if the partnership answered “Yes” to Form

Schedule B-1 (Form 1065) must be filed by all partnerships that

1065, Schedule B, question 3b. List each individual or estate

owning, directly or indirectly, an interest of 50% or more in the

answer “Yes” to question 3a or question 3b on Schedule B of

profit, loss, or capital of the partnership at the end of the tax

Form 1065. Attach Schedule B-1 to Form 1065.

year. Enter the name, social security or employer identification

Specific Instructions

number, country of citizenship (for an estate, the citizenship of

the decedent), and the maximum percentage interests owned,

directly or indirectly, in the profit, loss, or capital of the

Part I

partnership.

Complete Part I if the partnership answered “Yes” to Form

Example 2. A owns, directly, 50% of the profit, loss, or capital

1065, Schedule B, question 3a. List each corporation,

of Partnership X. B, the daughter of A, does not own, directly,

partnership, trust, tax-exempt organization, or foreign

any interest in X and does not own, indirectly, any interest in X

government owning, directly or indirectly, an interest of 50% or

through any entity (corporation, partnership, trust, or estate).

more in the profit, loss, or capital of the partnership at the end

Because family attribution rules apply only when an individual

of the tax year. Enter the name, EIN, type of entity (corporation,

(in this example, B) owns a direct interest in the partnership or

partnership, trust, tax-exempt organization, or foreign

an indirect interest through another entity, A’s interest in

government), country of organization, and the maximum

Partnership X is not attributable to B. On Partnership X’s Form

percentage interests owned, directly or indirectly, in the profit,

1065, it must answer “Yes” to question 3b of Schedule B.

loss, or capital of the partnership. For an affiliated group filing a

Partnership X must also complete Part II of Schedule B-1. In

consolidated tax return, list the parent corporation rather than

Part II, Partnership X must identify A, which includes entering

the subsidiary members. List the entity owner of a disregarded

“50%” in column (iv). Partnership X will not identify B in Part II.

entity rather than the disregarded entity. If the owner of a

disregarded entity is an individual rather than an entity, list the

individual in Part II. In the case of a tax-exempt organization,

enter “tax-exempt organization” in column (iii).

Example 1. Corporation A owns, directly, an interest of 50%

in the profit, loss, or capital of Partnership B. Corporation A

also owns, directly, an interest of 15% in the profit, loss, or

capital of Partnership C. Partnership B owns, directly, an

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1