Special Power Of Attorney (Poa) Form - Instructions

ADVERTISEMENT

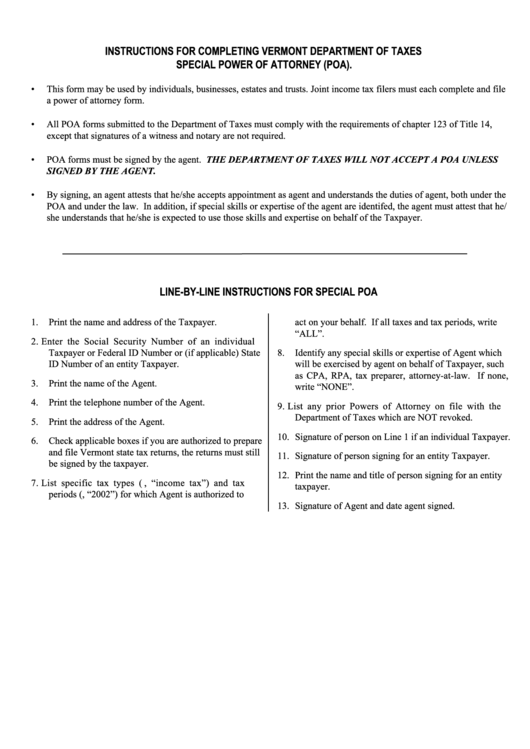

INSTRUCTIONS FOR COMPLETING VERMONT DEPARTMENT OF TAXES

SPECIAL POWER OF ATTORNEY (POA).

• This form may be used by individuals, businesses, estates and trusts. Joint income tax filers must each complete and file

a power of attorney form.

• All POA forms submitted to the Department of Taxes must comply with the requirements of chapter 123 of Title 14,

except that signatures of a witness and notary are not required.

• POA forms must be signed by the agent. THE DEPARTMENT OF TAXES WILL NOT ACCEPT A POA UNLESS

SIGNED BY THE AGENT.

• By signing, an agent attests that he/she accepts appointment as agent and understands the duties of agent, both under the

POA and under the law. In addition, if special skills or expertise of the agent are identifed, the agent must attest that he/

she understands that he/she is expected to use those skills and expertise on behalf of the Taxpayer.

LINE-BY-LINE INSTRUCTIONS FOR SPECIAL POA

1. Print the name and address of the Taxpayer.

act on your behalf. If all taxes and tax periods, write

“ALL”.

2. Enter the Social Security Number of an individual

Taxpayer or Federal ID Number or (if applicable) State

8. Identify any special skills or expertise of Agent which

ID Number of an entity Taxpayer.

will be exercised by agent on behalf of Taxpayer, such

as CPA, RPA, tax preparer, attorney-at-law. If none,

3. Print the name of the Agent.

write “NONE”.

4. Print the telephone number of the Agent.

9. List any prior Powers of Attorney on file with the

Department of Taxes which are NOT revoked.

5. Print the address of the Agent.

10. Signature of person on Line 1 if an individual Taxpayer.

6. Check applicable boxes if you are authorized to prepare

and file Vermont state tax returns, the returns must still

11. Signature of person signing for an entity Taxpayer.

be signed by the taxpayer.

12. Print the name and title of person signing for an entity

7. List specific tax types (i.e., “income tax”) and tax

taxpayer.

periods (i.e., “2002”) for which Agent is authorized to

13. Signature of Agent and date agent signed.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1