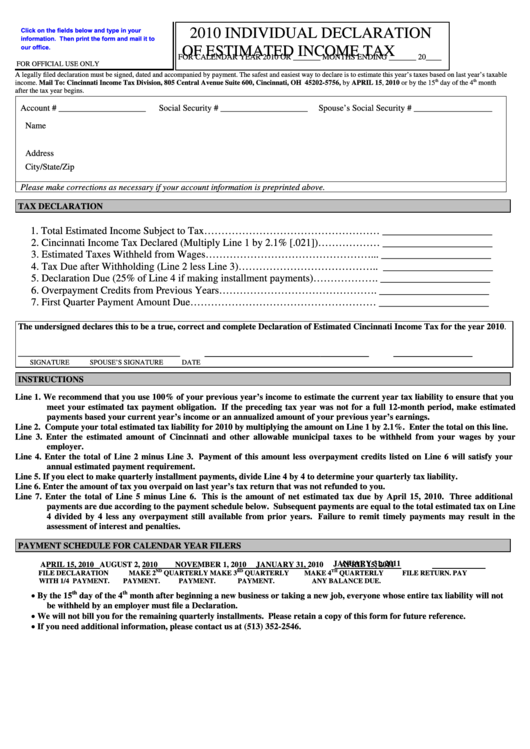

Form D-1 - 2010 Individual Declaration Of Estimated Income Tax

ADVERTISEMENT

Click on the fields below and type in your

2010 INDIVIDUAL DECLARATION

information. Then print the form and mail it to

our office.

OF ESTIMATED INCOME TAX

FOR CALENDAR YEAR 2010 OR _______ MONTHS ENDING _______ 20____

FOR OFFICIAL USE ONLY

A legally filed declaration must be signed, dated and accompanied by payment. The safest and easiest way to declare is to estimate this year’s taxes based on last year’s taxable

th

th

income. Mail To: Cincinnati Income Tax Division, 805 Central Avenue Suite 600, Cincinnati, OH 45202-5756, by APRIL 15, 2010 or by the 15

day of the 4

month

after the tax year begins.

Account # ____________________

Social Security # ____________________

Spouse’s Social Security # __________________

Name

Address

City/State/Zip

Please make corrections as necessary if your account information is preprinted above.

TAX DECLARATION

1. Total Estimated Income Subject to Tax……………………………………………

_____________________

2. Cincinnati Income Tax Declared (Multiply Line 1 by 2.1% [.021])………………

_____________________

3. Estimated Taxes Withheld from Wages…………………………………………...

_____________________

4. Tax Due after Withholding (Line 2 less Line 3)…………………………………..

_____________________

5. Declaration Due (25% of Line 4 if making installment payments)……………….

_____________________

6. Overpayment Credits from Previous Years……………………………………….

_____________________

7. First Quarter Payment Amount Due………………………………………………

_____________________

The undersigned declares this to be a true, correct and complete Declaration of Estimated Cincinnati Income Tax for the year 2010.

___________________________

_____________

_______________________________

SIGNATURE

SPOUSE’S SIGNATURE

DATE

INSTRUCTIONS

Line 1. We recommend that you use 100% of your previous year’s income to estimate the current year tax liability to ensure that you

meet your estimated tax payment obligation. If the preceding tax year was not for a full 12-month period, make estimated

payments based your current year’s income or an annualized amount of your previous year’s earnings.

Line 2. Compute your total estimated tax liability for 2010 by multiplying the amount on Line 1 by 2.1%. Enter the total on this line.

Line 3. Enter the estimated amount of Cincinnati and other allowable municipal taxes to be withheld from your wages by your

employer.

Line 4. Enter the total of Line 2 minus Line 3. Payment of this amount less overpayment credits listed on Line 6 will satisfy your

annual estimated payment requirement.

Line 5. If you elect to make quarterly installment payments, divide Line 4 by 4 to determine your quarterly tax liability.

Line 6. Enter the amount of tax you overpaid on last year’s tax return that was not refunded to you.

Line 7. Enter the total of Line 5 minus Line 6. This is the amount of net estimated tax due by April 15, 2010. Three additional

payments are due according to the payment schedule below. Subsequent payments are equal to the total estimated tax on Line

4 divided by 4 less any overpayment still available from prior years. Failure to remit timely payments may result in the

assessment of interest and penalties.

PAYMENT SCHEDULE FOR CALENDAR YEAR FILERS

JANUARY 31, 2011

APRIL 15, 2010

AUGUST 2, 2010

NOVEMBER 1, 2010

JANUARY 31, 2010

APRIL 15, 2011

ND

RD

TH

FILE DECLARATION

MAKE 2

QUARTERLY

MAKE 3

QUARTERLY

MAKE 4

QUARTERLY

FILE RETURN. PAY

WITH 1/4 PAYMENT.

PAYMENT.

PAYMENT.

PAYMENT.

ANY BALANCE DUE.

•

th

th

By the 15

day of the 4

month after beginning a new business or taking a new job, everyone whose entire tax liability will not

be withheld by an employer must file a Declaration.

•

We will not bill you for the remaining quarterly installments. Please retain a copy of this form for future reference.

•

If you need additional information, please contact us at (513) 352-2546.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2