Information And Forms Required For Payment To Non United States Citizens

ADVERTISEMENT

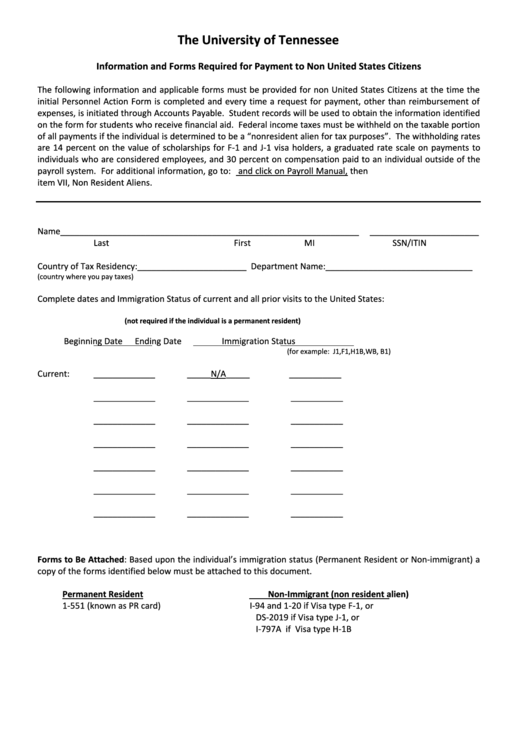

The University of Tennessee

Information and Forms Required for Payment to Non United States Citizens

The following information and applicable forms must be provided for non United States Citizens at the time the

initial Personnel Action Form is completed and every time a request for payment, other than reimbursement of

expenses, is initiated through Accounts Payable. Student records will be used to obtain the information identified

on the form for students who receive financial aid. Federal income taxes must be withheld on the taxable portion

of all payments if the individual is determined to be a “nonresident alien for tax purposes”. The withholding rates

are 14 percent on the value of scholarships for F‐1 and J‐1 visa holders, a graduated rate scale on payments to

individuals who are considered employees, and 30 percent on compensation paid to an individual outside of the

payroll system. For additional information, go to: , then

item VII, Non Resident Aliens.

Name_______________________________________________________________ _______________________

Last

First

MI

SSN/ITIN

Country of Tax Residency:_______________________ D epartment Name:_______________________________

(country where you pay taxes)

Complete dates and Immigration Status of current and all prior visits to the United States:

(not required if the individual is a permanent resident)

Beginning Date

Ending Date

Immigration Status

(for example: J1,F1,H1B,WB, B1)

Current:

_____________

_____N/A_____

___________

_____________

_____________

___________

_____________

_____________

___________

_____________

_____________

___________

_____________

_____________

___________

_____________

_____________

___________

_____________

_____________

___________

Forms to Be Attached: Based upon the individual’s immigration status (Permanent Resident or Non‐immigrant) a

copy of the forms identified below must be attached to this document.

Permanent Resident

Non‐Immigrant (non resident alien)

1‐551 (known as PR card)

I‐94 and 1‐20 if Visa type F‐1, or

DS‐2019 if Visa type J‐1, or

I‐797A if Visa type H‐1B

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2