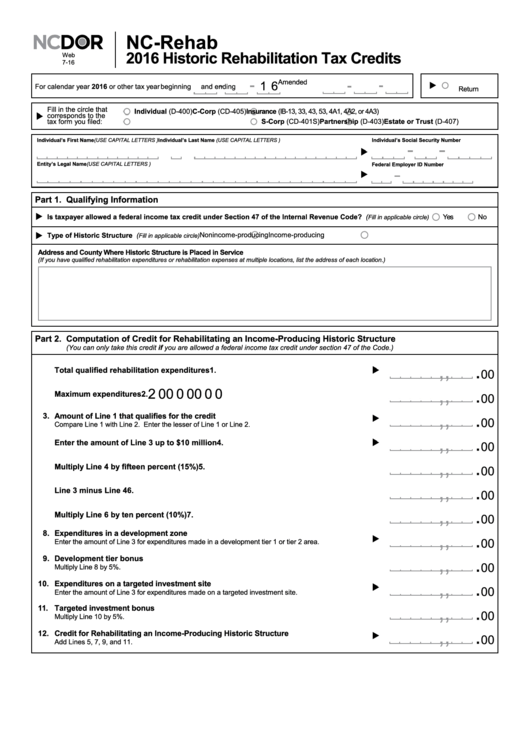

Form Nc-Rehab - Historic Rehabilitation Tax Credits - 2016

ADVERTISEMENT

NC-Rehab

2016 Historic Rehabilitation Tax Credits

Web

7-16

Amended

1 6

For calendar year 2016 or other tax year beginning

and ending

Return

Fill in the circle that

Individual (D-400)

C-Corp (CD-405)

Insurance (IB-13, 33, 43, 53, 4A1, 4A2, or 4A3)

corresponds to the

tax form you filed:

Estate or Trust (D-407)

S-Corp (CD-401S)

Partnership (D-403)

Individual’s First Name (USE CAPITAL LETTERS )

M.I.

Individual’s Last Name (USE CAPITAL LETTERS )

Individual’s Social Security Number

Entity’s Legal Name (USE CAPITAL LETTERS )

Federal Employer ID Number

Part 1.

Qualifying Information

Is taxpayer allowed a federal income tax credit under Section 47 of the Internal Revenue Code? (

Yes

No

Fill in applicable circle)

Income-producing

Nonincome-producing

Type of Historic Structure (

Fill in applicable circle)

Address and County Where Historic Structure is Placed in Service

(If you have qualified rehabilitation expenditures or rehabilitation expenses at multiple locations, list the address of each location.)

Part 2.

Computation of Credit for Rehabilitating an Income-Producing Historic Structure

(You can only take this credit if you are allowed a federal income tax credit under section 47 of the Code.)

,

,

.

1.

Total qualified rehabilitation expenditures

00

,

,

.

2 0 0 0 0 0 0 0

2.

Maximum expenditures

00

,

,

.

3.

Amount of Line 1 that qualifies for the credit

00

Compare Line 1 with Line 2. Enter the lesser of Line 1 or Line 2.

,

,

.

4.

Enter the amount of Line 3 up to $10 million

00

,

,

.

5.

Multiply Line 4 by fifteen percent (15%)

00

,

,

.

6.

Line 3 minus Line 4

00

,

,

.

7.

Multiply Line 6 by ten percent (10%)

00

,

,

.

8.

Expenditures in a development zone

00

Enter the amount of Line 3 for expenditures made in a development tier 1 or tier 2 area.

,

,

.

9.

Development tier bonus

00

Multiply Line 8 by 5%.

,

,

.

10.

Expenditures on a targeted investment site

00

Enter the amount of Line 3 for expenditures made on a targeted investment site.

,

,

.

11.

Targeted investment bonus

00

Multiply Line 10 by 5%.

,

,

.

12.

Credit for Rehabilitating an Income-Producing Historic Structure

00

Add Lines 5, 7, 9, and 11.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2