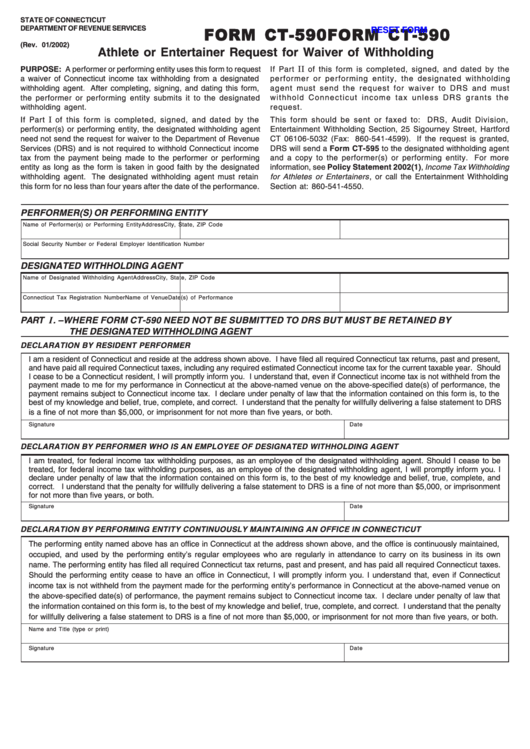

STATE OF CONNECTICUT

FORM CT-590

FORM CT-590

FORM CT-590

FORM CT-590

FORM CT-590

DEPARTMENT OF REVENUE SERVICES

RESET FORM

(Rev. 01/2002)

Athlete or Entertainer Request for Waiver of Withholding

II

PURPOSE: A performer or performing entity uses this form to request

If Part

of this form is completed, signed, and dated by the

a waiver of Connecticut income tax withholding from a designated

performer or performing entity, the designated withholding

withholding agent. After completing, signing, and dating this form,

agent must send the request for waiver to DRS and must

withhold Connecticut income tax unless DRS grants the

the performer or performing entity submits it to the designated

withholding agent.

request.

I

If Part

of this form is completed, signed, and dated by the

This form should be sent or faxed to: DRS, Audit Division,

performer(s) or performing entity, the designated withholding agent

Entertainment Withholding Section, 25 Sigourney Street, Hartford

need not send the request for waiver to the Department of Revenue

CT 06106-5032 (Fax: 860-541-4599). If the request is granted,

Services (DRS) and is not required to withhold Connecticut income

DRS will send a Form CT-595 to the designated withholding agent

and a copy to the performer(s) or performing entity. For more

tax from the payment being made to the performer or performing

entity as long as the form is taken in good faith by the designated

information, see Policy Statement 2002(1), Income Tax Withholding

for Athletes or Entertainers , or call the Entertainment Withholding

withholding agent. The designated withholding agent must retain

this form for no less than four years after the date of the performance.

Section at: 860-541-4550.

PERFORMER(S) OR PERFORMING ENTITY

Name of Performer(s) or Performing Entity

Address

City, State, ZIP Code

Social Security Number or Federal Employer Identification Number

DESIGNATED WITHHOLDING AGENT

Name of Designated Withholding Agent

Address

City, State, ZIP Code

Connecticut Tax Registration Number

Name of Venue

Date(s) of Performance

PART I . – WHERE FORM CT-590 NEED NOT BE SUBMITTED TO DRS BUT MUST BE RETAINED BY

THE DESIGNATED WITHHOLDING AGENT

DECLARATION BY RESIDENT PERFORMER

I am a resident of Connecticut and reside at the address shown above. I have filed all required Connecticut tax returns, past and present,

and have paid all required Connecticut taxes, including any required estimated Connecticut income tax for the current taxable year. Should

I cease to be a Connecticut resident, I will promptly inform you. I understand that, even if Connecticut income tax is not withheld from the

payment made to me for my performance in Connecticut at the above-named venue on the above-specified date(s) of performance, the

payment remains subject to Connecticut income tax. I declare under penalty of law that the information contained on this form is, to the

best of my knowledge and belief, true, complete, and correct. I understand that the penalty for willfully delivering a false statement to DRS

is a fine of not more than $5,000, or imprisonment for not more than five years, or both.

Signature

Date

DECLARATION BY PERFORMER WHO IS AN EMPLOYEE OF DESIGNATED WITHHOLDING AGENT

I am treated, for federal income tax withholding purposes, as an employee of the designated withholding agent. Should I cease to be

treated, for federal income tax withholding purposes, as an employee of the designated withholding agent, I will promptly inform you. I

declare under penalty of law that the information contained on this form is, to the best of my knowledge and belief, true, complete, and

correct. I understand that the penalty for willfully delivering a false statement to DRS is a fine of not more than $5,000, or imprisonment

for not more than five years, or both.

Signature

Date

DECLARATION BY PERFORMING ENTITY CONTINUOUSLY MAINTAINING AN OFFICE IN CONNECTICUT

The performing entity named above has an office in Connecticut at the address shown above, and the office is continuously maintained,

occupied, and used by the performing entity’s regular employees who are regularly in attendance to carry on its business in its own

name. The performing entity has filed all required Connecticut tax returns, past and present, and has paid all required Connecticut taxes.

Should the performing entity cease to have an office in Connecticut, I will promptly inform you. I understand that, even if Connecticut

income tax is not withheld from the payment made for the performing entity’s performance in Connecticut at the above-named venue on

the above-specified date(s) of performance, the payment remains subject to Connecticut income tax. I declare under penalty of law that

the information contained on this form is, to the best of my knowledge and belief, true, complete, and correct. I understand that the penalty

for willfully delivering a false statement to DRS is a fine of not more than $5,000, or imprisonment for not more than five years, or both.

Name and Title (type or print)

Signature

Date

1

1 2

2