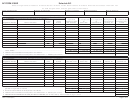

AZ FORM 819NR

Instructions

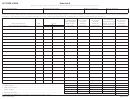

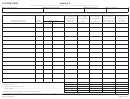

List each invoice on a separate line with the name and address of

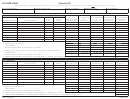

(i.e., round .1 oz. - .4 oz. down to 0 oz., round .5 oz. - .9 oz. up to

who the product was sold to, the date and number of the invoice,

1 oz.). Enter totals here.

and the total number of items or total number of ounces shipped,

Line 8: Calculate the number of items and number of ounces from

whichever is applicable.

Do not round ounces of individual

line 7 that were sold tax free. Enter totals here.

packages.

Line 9: Multiply the totals on line 8 by the total tax rate. Enter

Sum the total number of items shipped and the total number of

amounts here.

ounces shipped from all invoices. If necessary, round the total

Line 10: Add amounts from line 9. Enter total here.

number of ounces received from all invoices to the whole ounce.

Line 11: Add lines 6 and 10. Enter total here and on page 1,

Round partial ounces of cavendish, plug, or twist up to the next

line 2.

highest ounce (i.e., round .1 oz. - .9 oz. up to 1 oz.). Round partial

ounces of smoking tobacco, snuff, fi ne cut chewing, etc. to the

NOTE: Form 819NR does not contain

nearest ounce (i.e., round .1 oz. - .4 oz. down to 0 oz., round .5 oz.

Schedule A-1 or Schedule A-2.

- .9 oz. up to 1 oz.).

Multiply the total number of items and the total number of ounces

Special Defi nitions for Schedule A-3 and

shipped during the month by the appropriate tax rate to calculate

Schedule A-4:

“Net Taxes this Month.”

“Cigarette” means any product that contains nicotine, is intended

Sum the “Net Taxes This Month” to calculate the “Total Taxes This

to be burned or heated under ordinary conditions of use, and

Month”. Enter this amount on page 1, line 1.

consists of or contains: (1) any roll of tobacco wrapped in paper

Retailers whose registration numbers end in “-1” are either owned

or in any substance not containing tobacco; or (2) tobacco, in

by an Indian tribe, a tribal enterprise, or an enrolled member of

any form, that is functional in the product, which, because of its

the tribe. These retailers should collect both the §42-3251 and

appearance, the type of tobacco used in the fi ller, or its packaging

§42-3251.01 tax rates when selling to a non-enrolled member of

and labeling, is likely to be offered to, or purchased by, consumers

the tribe.

as a cigarette; or (3) any roll of tobacco wrapped in any substance

Retailers whose registration numbers end in “-2” are licensed

containing tobacco which, because of its appearance, the type of

Indian traders. These retailers should collect the §42-3052, the

tobacco used in the fi ller, or its packaging and labeling, is likely to

§42-3251, and the §42-3251.01 tax rates when selling to a non-

be offered to, or purchased by, consumers as a cigarette described

enrolled member of the tribe.

in clause (1) of this defi nition. The term “cigarette” includes “roll-

your-own” tobacco as defi ned below.

For “-1” retailers, enter the registration number, name, invoice

date and number, and the total number of items or total number of

“Roll-your-own” tobacco means any tobacco which, because of its

ounces sold, whichever is applicable. Do not round off ounces of

appearance, type, packaging, or labeling is suitable for use and

individual packages.

likely to be offered to, or purchased by, consumers as tobacco for

making cigarettes.

Line 1: Sum the total number of items sold and the total number of

ounces sold from all invoices. If necessary, round the total number

“Brand family” means all styles of cigarettes sold under the same

of ounces sold from all invoices to the whole ounce. Round partial

trademark and differentiated from one another by means of

ounces of cavendish, plug, or twist up to the next highest ounce

additional modifi ers or descriptors, including, but not limited to,

(i.e., round .1 oz. - .9 oz. up to 1 oz.). Round partial ounces of

“menthol”, “lights”, “kings”, and “100s”, and includes any brand

smoking tobacco, snuff, fi ne cut chewing, etc. to the nearest ounce

name (alone or in conjunction with any other word), trademark,

(i.e., round .1 oz. - .4 oz. down to 0 oz., round .5 oz. - .9 oz. up to

logo, symbol, motto, selling message, recognizable pattern

1 oz.). Enter totals here.

of colors or any other indicia of product identifi cation identical

or similar to, or identifi able with, a previously known brand of

Line 2: Calculate the number of items and number of ounces from

cigarettes.

line 1 that were sold tax free. Enter totals here.

“Master Settlement Agreement” means the settlement agreement

Line 3: Multiply the totals on line 2 by the total tax rates. Enter

(and related documents) entered into on November 23, 1998

amounts here.

by the State and leading United States tobacco product

Line 4: Calculate the number of items and number of ounces from

manufacturers.

A copy of the Master Settlement Agreement

line 1 that were sold for which both the §42-3251 and the §42-

may be found at the web site of National Association of Attorneys

3251.01 tax rates were collected. Enter totals here.

General,

Line 5: Multiply the totals on line 4 by the §42-3052 tax rates.

“Tobacco product manufacturer” means an entity that directly (and

Enter amounts here.

not exclusively through any affi liate):

Line 6: Add amounts from lines 3 and 5. Enter total here.

1) Manufactures cigarettes anywhere that such manufacturer

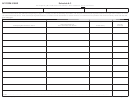

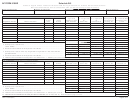

For “-2” retailers, enter the registration number, name, invoice

intends to be sold in the United States, including cigarettes

date and number, and the total number of items or total number of

intended to be sold in the United States through an importer

ounces sold, whichever is applicable. Do not round off ounces of

(except where such importer is an original participating

individual packages.

manufacturer (as that term is defi ned in the Master

Line 7: Sum the total number of items sold and the total number of

Settlement Agreement) that will be responsible for the

payments under the Master Settlement Agreement with

ounces sold from all invoices. If necessary, round the total number

respect to such cigarettes as a result of the provisions of

of ounces sold from all invoices to the whole ounce. Round partial

subsection II(MM) of the Master Settlement Agreement and

ounces of cavendish, plug, or twist up to the next highest ounce

that pays the taxes specifi ed in subsection II(Z) of the Master

(i.e., round .1 oz. - .9 oz. up to 1 oz.). Round partial ounces of

Settlement Agreement, and provided that the manufacturer

smoking tobacco, snuff, fi ne cut chewing, etc. to the nearest ounce

Page 14 of 17

ADOR 14-5322 (8/05)

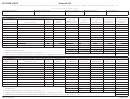

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17