Form Rv-F-1303501 - Application For Refund Of Sales Tax Paid On The Purchase Of All-Terrain Vehicles Used As Farm Equipment - Tennessee Department Of Revenue

ADVERTISEMENT

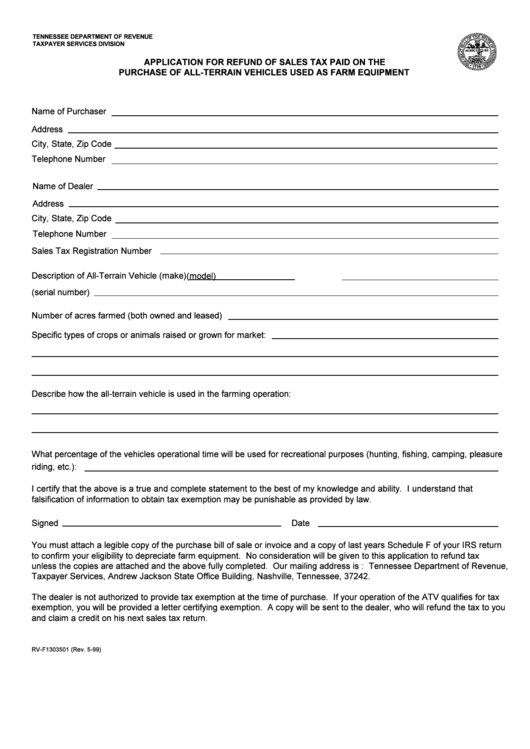

TENNESSEE DEPARTMENT OF REVENUE

TAXPAYER SERVICES DIVISION

APPLICATION FOR REFUND OF SALES TAX PAID ON THE

PURCHASE OF ALL-TERRAIN VEHICLES USED AS FARM EQUIPMENT

Name of Purchaser

Address

City, State, Zip Code

Telephone Number

Name of Dealer

Address

City, State, Zip Code

Telephone Number

Sales Tax Registration Number

Description of All-Terrain Vehicle (make)

(model)

(serial number)

Number of acres farmed (both owned and leased)

Specific types of crops or animals raised or grown for market:

Describe how the all-terrain vehicle is used in the farming operation:

What percentage of the vehicles operational time will be used for recreational purposes (hunting, fishing, camping, pleasure

riding, etc.):

I certify that the above is a true and complete statement to the best of my knowledge and ability. I understand that

falsification of information to obtain tax exemption may be punishable as provided by law.

Signed

Date

You must attach a legible copy of the purchase bill of sale or invoice and a copy of last years Schedule F of your IRS return

to confirm your eligibility to depreciate farm equipment. No consideration will be given to this application to refund tax

unless the copies are attached and the above fully completed. Our mailing address is : Tennessee Department of Revenue,

Taxpayer Services, Andrew Jackson State Office Building, Nashville, Tennessee, 37242.

The dealer is not authorized to provide tax exemption at the time of purchase. If your operation of the ATV qualifies for tax

exemption, you will be provided a letter certifying exemption. A copy will be sent to the dealer, who will refund the tax to you

and claim a credit on his next sales tax return.

RV-F1303501 (Rev. 5-99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1