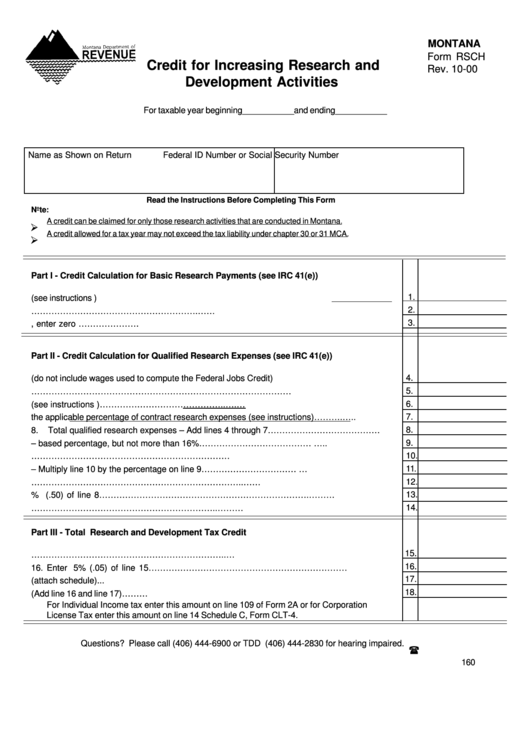

Montana Form Rsch - Credit For Increasing Research And Development Activities

ADVERTISEMENT

MONTANA

Form RSCH

Credit for Increasing Research and

Rev. 10-00

Development Activities

For taxable year beginning___________and ending___________

Name as Shown on Return

Federal ID Number or Social Security Number

Read the Instructions Before Completing This Form

Note:

A credit can be claimed for only those research activities that are conducted in Montana.

A credit allowed for a tax year may not exceed the tax liability under chapter 30 or 31 MCA.

Part I - Credit Calculation for Basic Research Payments (see IRC 41(e))

1.

1. Enter the basic research payments paid or incurred to qualified organizations (see instructions )

2.

2. Qualified organization base period amount ………………………………………………….……

3.

3. Subtract line 2 from line 1. If less than zero, enter zero ………………….............................

Part II - Credit Calculation for Qualified Research Expenses (see IRC 41(e))

4.

4. Wages for qualified services (do not include wages used to compute the Federal Jobs Credit)

5.

5. Cost of supplies ………………………………………………………………………………........

6.

6. Rental or lease costs of computers (see instructions )……………………………………..….…

7. Enter the applicable percentage of contract research expenses (see instructions)……….…..

7.

8.

8.

Total qualified research expenses – Add lines 4 through 7…………………………………......

9.

9. Enter fixed – based percentage, but not more than 16%…………………………………....…..

10.

10. Enter average annual gross receipts……………………………………………………………....

11. Base amount – Multiply line 10 by the percentage on line 9……………………………....…....

11.

12.

12. Subtract line 11 from line 8………………………………………………………………..…….....

13.

13. Enter 50% (.50) of line 8……………………………………………………………….……….....

14.

14. Enter the smaller of line 12 or 13………………………………………………………..………....

Part III - Total Research and Development Tax Credit

15.

15. Enter the total of line 3 and line 14…………………………………………………………..….....

16.

16. Enter 5% (.05) of line 15……………………………………………………………....................

17.

17. Research and Development Tax Credit carried forward from a prior year (attach schedule)...

18.

18. Total Research and Development Tax Credit Available (Add line 16 and line 17)………..........

For Individual Income tax enter this amount on line 109 of Form 2A or for Corporation

License Tax enter this amount on line 14 Schedule C, Form CLT-4.

Questions? Please call (406) 444-6900 or TDD (406) 444-2830 for hearing impaired.

160

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1