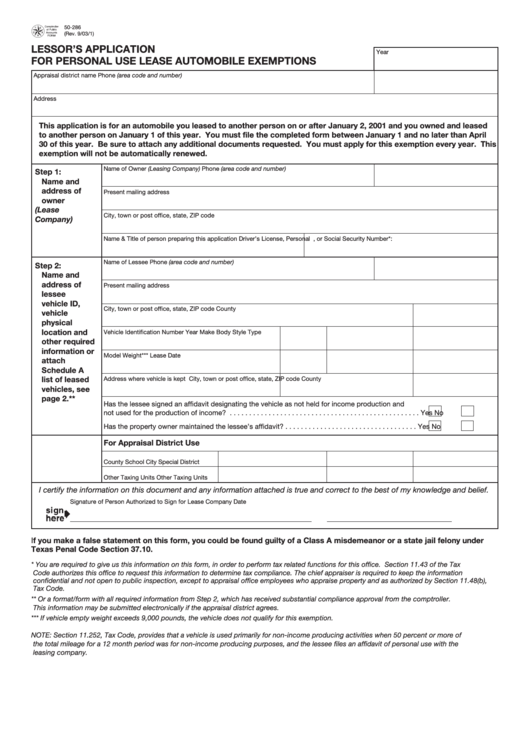

50-286

(Rev. 9/03/1)

LESSOR’S APPLICATION

Year

FOR PERSONAL USE LEASE AUTOMOBILE EXEMPTIONS

Appraisal district name

Phone (area code and number)

Address

This application is for an automobile you leased to another person on or after January 2, 2001 and you owned and leased

to another person on January 1 of this year. You must file the completed form between January 1 and no later than April

30 of this year. Be sure to attach any additional documents requested. You must apply for this exemption every year. This

exemption will not be automatically renewed.

Name of Owner (Leasing Company)

Phone (area code and number)

Step 1:

Name and

address of

Present mailing address

owner

(Lease

City, town or post office, state, ZIP code

Company)

Name & Title of person preparing this application

Driver’s License, Personal I.D. Certificate, or Social Security Number*:

Name of Lessee

Phone (area code and number)

Step 2:

Name and

address of

Present mailing address

lessee

vehicle ID,

City, town or post office, state, ZIP code

County

vehicle

physical

location and

Vehicle Identification Number

Year

Make

Body Style Type

other required

information or

Model

Weight***

Lease Date

attach

Schedule A

list of leased

Address where vehicle is kept

City, town or post office, state, ZIP code

County

vehicles, see

page 2.**

Has the lessee signed an affidavit designating the vehicle as not held for income production and

not used for the production of income? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Has the property owner maintained the lessee’s affidavit? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

For Appraisal District Use

County

School

City

Special District

Other Taxing Units

Other Taxing Units

I certify the information on this document and any information attached is true and correct to the best of my knowledge and belief.

Signature of Person Authorized to Sign for Lease Company

Date

If you make a false statement on this form, you could be found guilty of a Class A misdemeanor or a state jail felony under

Texas Penal Code Section 37.10.

*

You are required to give us this information on this form, in order to perform tax related functions for this office. Section 11.43 of the Tax

Code authorizes this office to request this information to determine tax compliance. The chief appraiser is required to keep the information

confidential and not open to public inspection, except to appraisal office employees who appraise property and as authorized by Section 11.48(b),

Tax Code.

** Or a format/form with all required information from Step 2, which has received substantial compliance approval from the comptroller.

This information may be submitted electronically if the appraisal district agrees.

*** If vehicle empty weight exceeds 9,000 pounds, the vehicle does not qualify for this exemption.

NOTE: Section 11.252, Tax Code, provides that a vehicle is used primarily for non-income producing activities when 50 percent or more of

the total mileage for a 12 month period was for non-income producing purposes, and the lessee files an affidavit of personal use with the

leasing company.

1

1 2

2