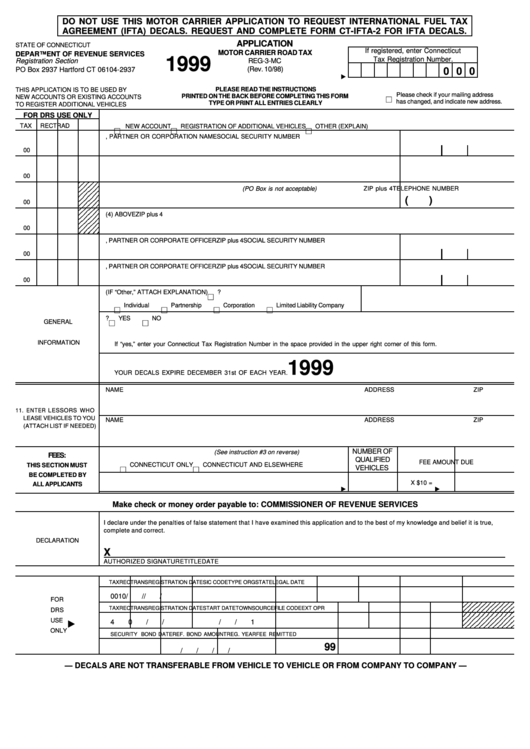

DO NOT USE THIS MOTOR CARRIER APPLICATION TO REQUEST INTERNATIONAL FUEL TAX

AGREEMENT (IFTA) DECALS. REQUEST AND COMPLETE FORM CT-IFTA-2 FOR IFTA DECALS.

APPLICATION

STATE OF CONNECTICUT

If registered, enter Connecticut

MOTOR CARRIER ROAD TAX

DEPARTMENT OF REVENUE SERVICES

1999

Tax Registration Number.

Registration Section

REG-3-MC

(Rev. 10/98)

PO Box 2937 Hartford CT 06104-2937

0 0 0

PLEASE READ THE INSTRUCTIONS

THIS APPLICATION IS TO BE USED BY

Please check if your mailing address

PRINTED ON THE BACK BEFORE COMPLETING THIS FORM

NEW ACCOUNTS OR EXISTING ACCOUNTS

has changed, and indicate new address.

TYPE OR PRINT ALL ENTRIES CLEARLY

TO REGISTER ADDITIONAL VEHICLES

FOR DRS USE ONLY

1. REASON FOR APPLYING

TAX

REC

TR

AD

NEW ACCOUNT

REGISTRATION OF ADDITIONAL VEHICLES

OTHER (EXPLAIN)

2. PRINT OWNER, PARTNER OR CORPORATION NAME

SOCIAL SECURITY NUMBER

00

3. PRINT TRADE NAME OR REGISTERED NAME IF DIFFERENT FROM NAME IN LINE 2

FEDERAL EMPLOYER ID NUMBER

00

1 2 3 4 5

1 2 3 4 5

1 2 3 4 5

4. PRINT PHYSICAL LOCATION OF BUSINESS (PO Box is not acceptable)

ZIP plus 4

TELEPHONE NUMBER

1 2 3 4 5

1 2 3 4 5

(

)

1 2 3 4 5

00

1 2 3 4 5

1 2 3 4 5

1 2 3 4 5

5. PRINT MAILING ADDRESS OF BUSINESS IF DIFFERENT FROM (4) ABOVE

ZIP plus 4

1 2 3 4 5

1 2 3 4 5

1 2 3 4 5

00

1 2 3 4 5

6. PRINT NAME AND HOME ADDRESS OF OWNER, PARTNER OR CORPORATE OFFICER ZIP plus 4

SOCIAL SECURITY NUMBER

00

7. PRINT NAME AND HOME ADDRESS OF OWNER, PARTNER OR CORPORATE OFFICER ZIP plus 4

SOCIAL SECURITY NUMBER

00

8. TYPE OF OWNERSHIP (IF “Other,” ATTACH EXPLANATION)

Other

8A. ORGANIZED UNDER LAWS OF WHAT STATE?

Individual

Partnership

Corporation

Limited Liability Company

9. ARE YOU CURRENTLY REGISTERED WITH THE CONNECTICUT DEPARTMENT OF REVENUE SERVICES?

YES

NO

GENERAL

INFORMATION

If “yes,” enter your Connecticut Tax Registration Number in the space provided in the upper right corner of this form.

10. YOU ARE APPLYING FOR IDENTIFICATION MARKERS FOR THE CALENDAR YEAR

1999

YOUR DECALS EXPIRE DECEMBER 31st OF EACH YEAR.

NAME

ADDRESS

ZIP

11. ENTER LESSORS WHO

LEASE VEHICLES TO YOU

NAME

ADDRESS

ZIP

(ATTACH LIST IF NEEDED)

NUMBER OF

12. ENTER EXTENT OF OPERATIONS (See instruction #3 on reverse)

FEES:

QUALIFIED

FEE

AMOUNT DUE

CONNECTICUT ONLY

CONNECTICUT AND ELSEWHERE

THIS SECTION MUST

VEHICLES

BE COMPLETED BY

13. ENTER TOTAL NUMBER OF DECAL SETS REQUESTED

X $10 =

ALL APPLICANTS

Make check or money order payable to: COMMISSIONER OF REVENUE SERVICES

I declare under the penalties of false statement that I have examined this application and to the best of my knowledge and belief it is true,

complete and correct.

DECLARATION

X

AUTHORIZED SIGNATURE

TITLE

DATE

TAX

REC

TRANS

REGISTRATION DATE

SIC CODE

TYPE ORG

STATE

LEGAL DATE

00

10

/

/

/

/

1 2 3 4 5 6 7 8 9 0 1 2

FOR

1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2

TAX

REC

TRANS

REGISTRATION DATE

START DATE

TOWN

SOURCE

FILE CODE

EXT OPR

DRS

1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2

USE

40

/

/

/

/

1

1 2 3 4 5 6 7 8 9 0 1 2

ONLY

SECURITY NO.

SECURITY DATE

SECURITY AMOUNT

REF. BOND DATE

REF. BOND AMOUNT

REG. YEAR

FEE REMITTED

99

/

/

/

/

— DECALS ARE NOT TRANSFERABLE FROM VEHICLE TO VEHICLE OR FROM COMPANY TO COMPANY —

1

1