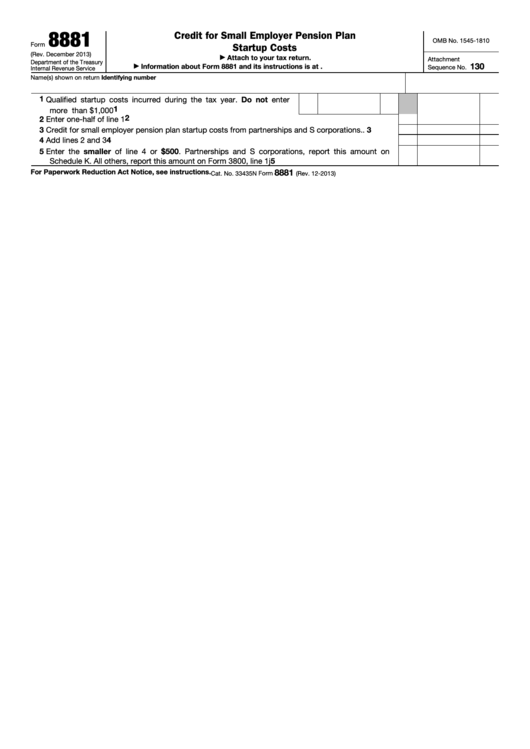

Form 8881 - Credit For Small Employer Pension Plan Startup Costs

ADVERTISEMENT

8881

Credit for Small Employer Pension Plan

OMB No. 1545-1810

Form

Startup Costs

(Rev. December 2013)

Attach to your tax return.

Attachment

Department of the Treasury

Information about Form 8881 and its instructions is at

130

Sequence No.

Internal Revenue Service

Name(s) shown on return

Identifying number

1 Qualified startup costs incurred during the tax year. Do not enter

1

more than $1,000 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

2 Enter one-half of line 1 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3 Credit for small employer pension plan startup costs from partnerships and S corporations

.

.

3

4 Add lines 2 and 3 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

5 Enter the smaller of line 4 or $500. Partnerships and S corporations, report this amount on

Schedule K. All others, report this amount on Form 3800, line 1j

.

.

.

.

.

.

.

.

.

.

.

5

For Paperwork Reduction Act Notice, see instructions.

8881

Form

(Rev. 12-2013)

Cat. No. 33435N

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1