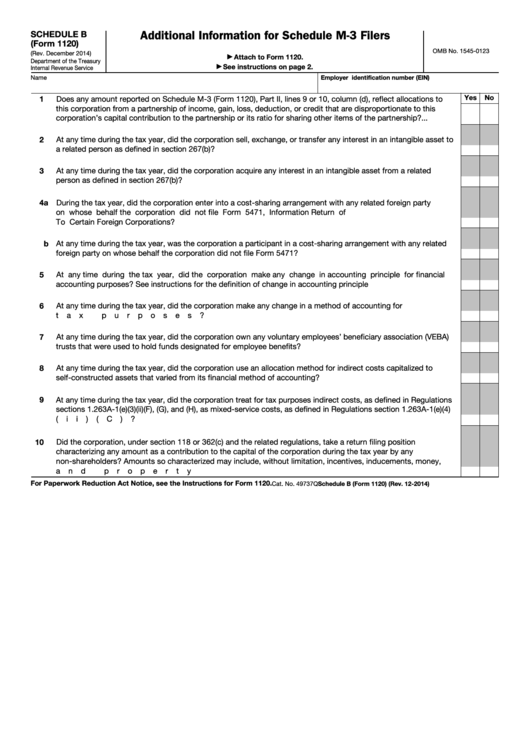

Additional Information for Schedule M-3 Filers

SCHEDULE B

(Form 1120)

OMB No. 1545-0123

(Rev. December 2014)

Attach to Form 1120.

▶

Department of the Treasury

See instructions on page 2.

▶

Internal Revenue Service

Employer identification number (EIN)

Name

Yes

No

1

Does any amount reported on Schedule M-3 (Form 1120), Part II, lines 9 or 10, column (d), reflect allocations to

this corporation from a partnership of income, gain, loss, deduction, or credit that are disproportionate to this

corporation’s capital contribution to the partnership or its ratio for sharing other items of the partnership? .

.

.

2

At any time during the tax year, did the corporation sell, exchange, or transfer any interest in an intangible asset to

a related person as defined in section 267(b)? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

At any time during the tax year, did the corporation acquire any interest in an intangible asset from a related

person as defined in section 267(b)? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4a During the tax year, did the corporation enter into a cost-sharing arrangement with any related foreign party

on whose behalf the corporation did not file Form 5471, Information Return of U.S. Persons With Respect

To Certain Foreign Corporations?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

b At any time during the tax year, was the corporation a participant in a cost-sharing arrangement with any related

foreign party on whose behalf the corporation did not file Form 5471? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

At any time during the tax year, did the corporation make any change in accounting principle for financial

accounting purposes? See instructions for the definition of change in accounting principle .

.

.

.

.

.

.

.

6

At any time during the tax year, did the corporation make any change in a method of accounting for U.S. income

tax purposes?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

At any time during the tax year, did the corporation own any voluntary employees’ beneficiary association (VEBA)

trusts that were used to hold funds designated for employee benefits?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

At any time during the tax year, did the corporation use an allocation method for indirect costs capitalized to

self-constructed assets that varied from its financial method of accounting? .

.

.

.

.

.

.

.

.

.

.

.

.

9

At any time during the tax year, did the corporation treat for tax purposes indirect costs, as defined in Regulations

sections 1.263A-1(e)(3)(ii)(F), (G), and (H), as mixed-service costs, as defined in Regulations section 1.263A-1(e)(4)

(ii)(C)? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Did the corporation, under section 118 or 362(c) and the related regulations, take a return filing position

10

characterizing any amount as a contribution to the capital of the corporation during the tax year by any

non-shareholders? Amounts so characterized may include, without limitation, incentives, inducements, money,

and property .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

For Paperwork Reduction Act Notice, see the Instructions for Form 1120.

Cat. No. 49737Q

Schedule B (Form 1120) (Rev. 12-2014)

1

1