Form 83-T-104a - Employee Earnings Tax Account Application - City Of Philadelphia - Department Of Revenue

ADVERTISEMENT

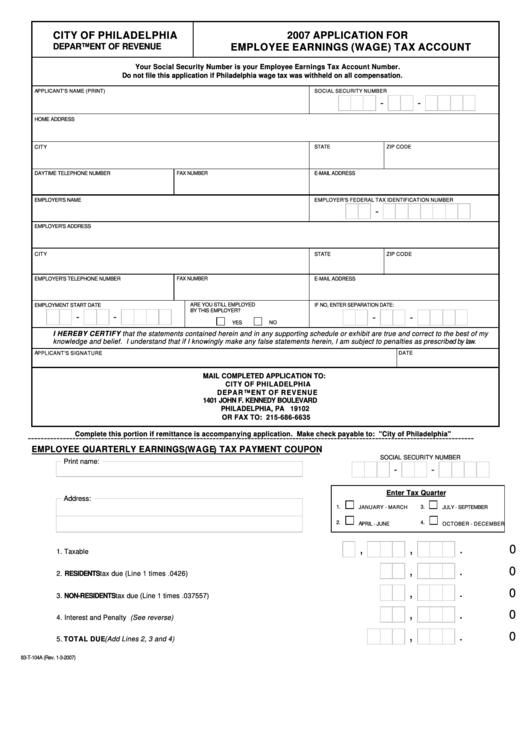

CITY OF PHILADELPHIA

2007 APPLICATION FOR

DEPARTMENT OF REVENUE

EMPLOYEE EARNINGS (WAGE) TAX ACCOUNT

Your Social Se curity Number is your Em ployee Earnings Tax Account Number.

Do not file this application if Philadelphia wage tax was withheld on all compensation.

APPLICANT'S NAME (PRINT)

SOCIAL SE CURITY NUMBER

-

-

HOME ADDRESS

CITY

STATE

ZIP CODE

DAYTIME TELEPHONE NUMBER

FAX NUMBER

E-MAIL A DDRESS

EMPLOY ER'S NAME

EMPLOY ER'S FEDERAL TAX I DENTIFICATION NUMBER

-

EMPLOY ER'S ADDRESS

CITY

STATE

ZIP CODE

EMPLOYER'S TELE PHONE NUMBER

FAX NUMBER

E-MAIL A DDRESS

ARE YO U STILL E MPLOYED

EMPLOY MENT START DATE

IF NO, ENTER SEP ARATION DATE:

BY THIS EMPLO YER?

-

-

-

-

YES

NO

I HEREBY CERTIFY that the statements contained herein and in any supporting schedule or exhibit are true and correct to the best of my

knowledge and belief. I understand that if I knowingly make any false statements herein, I am subject to penalties as prescribed by law.

APPLICANT'S SIG NATURE

DATE

M AIL COM PLETED APPLICATION TO:

CITY OF PHILADELPHIA

DEPARTMENT OF REVENUE

1401 JOHN F. KENNEDY BOULEV ARD

PHILADELPHI A, PA 19102

OR FAX TO: 215-686-6635

Complete this portion if remittance is accompanying application. Make check payable to: "City of Philadelphia"

--------------------------------------------------------------------------------------------------------------------------------------------

EMPLOYEE QUARTERLY EARNINGS (WAGE) TAX PAYMENT COUPON

SOCIAL SECURITY NUMBER

Print name:

-

-

Enter Tax Quarter

Address:

1.

3.

JANUARY - MARCH

JULY - S EPTEMBER

2.

4.

APRIL - JUNE

OCTOBER - DECEMBER

,

,

. 0 0

1. Taxable Compensation........................... .............................. ............... ............... .........

,

. 0 0

2. RESIDENTS tax due (Line 1 times .0426).................... ............... ............... ............... ..

,

. 0 0

3. NON-RESIDENTS tax due (Line 1 times .037557)................... ............... ............... .....

,

. 0 0

4. Interest and Penalty (See reverse)................. .............................. ............... ...............

,

. 0 0

5. TOTAL DUE (Add Lines 2, 3 and 4) ........................ ............... ............... ......................

83-T-104A (Rev. 1-3-2007)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1