Dbpr Form Ab&t 4000a-140-1 - Wine Manufacturer'S Monthly Report - Department Of Business And Professional Regulation - Florida

ADVERTISEMENT

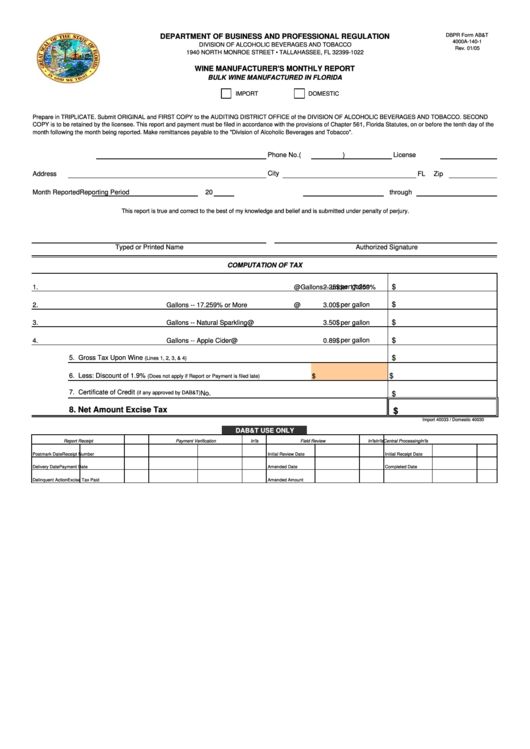

DBPR Form AB&T

DEPARTMENT OF BUSINESS AND PROFESSIONAL REGULATION

4000A-140-1

DIVISION OF ALCOHOLIC BEVERAGES AND TOBACCO

Rev. 01/05

1940 NORTH MONROE STREET • TALLAHASSEE, FL 32399-1022

WINE MANUFACTURER'S MONTHLY REPORT

BULK WINE MANUFACTURED IN FLORIDA

IMPORT

DOMESTIC

Prepare in TRIPLICATE. Submit ORIGINAL and FIRST COPY to the AUDITING DISTRICT OFFICE of the DIVISION OF ALCOHOLIC BEVERAGES AND TOBACCO. SECOND

COPY is to be retained by the licensee. This report and payment must be filed in accordance with the provisions of Chapter 561, Florida Statutes, on or before the tenth day of the

month following the month being reported. Make remittances payable to the "Division of Alcoholic Beverages and Tobacco".

Licensee Name

Phone No.

(

)

License No.

Address

City

FL

Zip

Month Reported

20

Reporting Period

through

This report is true and correct to the best of my knowledge and belief and is submitted under penalty of perjury.

Typed or Printed Name

Authorized Signature

COMPUTATION OF TAX

$

1.

Gallons -- under 17.259%

@

$

2.25

per gallon

per gallon

$

2.

Gallons -- 17.259% or More

@

$

3.00

$

per gallon

3.

Gallons -- Natural Sparkling

@

$

3.50

$

4.

Gallons -- Apple Cider

@

$

0.89

per gallon

$

5. Gross Tax Upon Wine

(Lines 1, 2, 3, & 4)

6. Less: Discount of 1.9%

$

$

(Does not apply if Report or Payment is filed late)

7. Certificate of Credit

(if any approved by DAB&T)

No.

$

8. Net Amount Excise Tax

$

Import 40033 / Domestic 40030

DAB&T USE ONLY

Report Receipt

In'ls

Payment Verification

In'ls

Field Review

In'ls

Central Processing

In'ls

Postmark Date

Receipt Number

Initial Review Date

Initial Receipt Date

Delivery Date

Payment Date

Amended Date

Completed Date

Delinquent Action

Excise Tax Paid

Amended Amount

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1