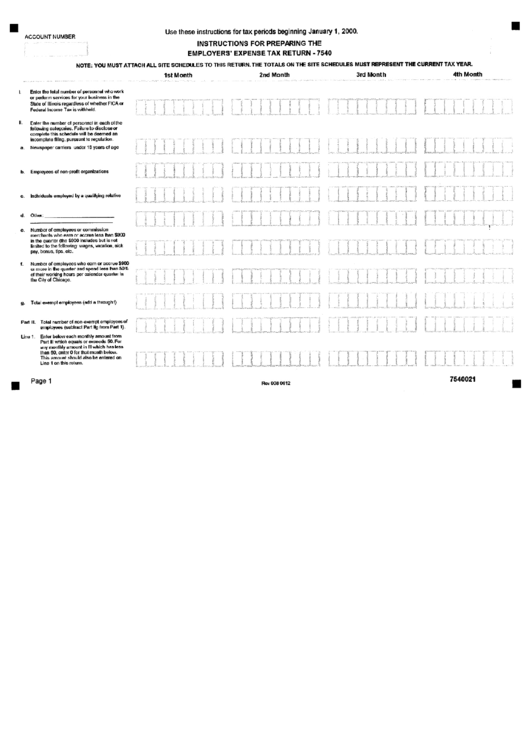

Employer'S Expense Tax Return Form

ADVERTISEMENT

I I

Use

these

instructions

for tax

pedods

beginning

January

1, 2000.

ACCOUNT NUMBER

.....................

~

INSTRUCTIONS

FOR

PREPARING

THE

....................

EMPLOYERS'

EXPENSE

TAX

RETURN

- 7540

NOTE: YOU MUST ATTACH ALL SITE SCHEDULES TO THIS RETURN. THE TOTALS ON THE SITE SCHEDULES MUST REPRESENT THE CURRENT TAX YEAR.

1 s t M o n t h

2 n d M o n t h

3 r d M o n t h

4 t h M o n t h

Enter the total number of personnel whowork

or perform services for your business in the

State of Illinois regardless of whether FICA

O

r

F

e

d

e

r

a

l

Income Tax is withheld.

.

"

i i i

i i i

i i i

ii

i

ii

II.

Enter the number of personnel in each of the

following categories. Failure to disclose or

complete this schedule will be deemed an

incomplete filing, pursuant to regulation.

a.

Newspaper carriers under 18 years of age

b.

Employees of non-profit organizations

i

....

iii

i

!ii

i

ii

i

I I

c.

Individuals employed by a qualifying relative

i ......... i .....................

i ...... ! ..... i ............... i

.............................................................

i

...... i ....... i

! i

....................................

Other:

Number of employees or commission

merchants who earn or accrue less Ihan $900

in the quarter (the $900 includes but is not

limited to the following: wages, vacation, sick

pay, bonus, tips, etc.

Number of employees who earn or accrue $900

or more in the quader and spend less Ihan 50%

of their working hours per calendar quarter in

the City of Chicago.

................................................................................................

i !

..................................................................

i

....................................................................

i .................................................. ~ ................. i ..................................... i ............................................. i .................

........

i

i

"

¸

i

.....

g.

Total exempt employees (add a through0

i.....¸iii.._¸¸il .......... ii .......... ii ........ ii .......... i ~

ii ....... il ....... ii

il ............. !i ............ !i .......... ii ........ !i ............. ii.r......il ............ ii ............ i! .......... ii

i ~ ...... ~i ........... i ~ ............ ~!

........... i~ ........... ~i.

Pad III.

Line 1.

Total number of non-exempt employees of

employees (subtract Part IIg from Part 1).

Enter below each monthly amount from

Part III which equals or exceeds 50. For

any monthly amount in III which has less

than 50, enter 0 for that month below.

This amount should also be entered on

Line 1 on this return.

.................... !...i .......................... i ......... i .... i ..........

il ................. i ..................... i ............ i.i...i i..,ii! . . . . . . . . . . . . . .......... .............................................. i

7540021

BB

Page 1

Rev 008 0612

B

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4