Form 7585 - Instructions For Preparing The Intertrack Wagering Mutuel Handle Tax Return 2000

ADVERTISEMENT

I I

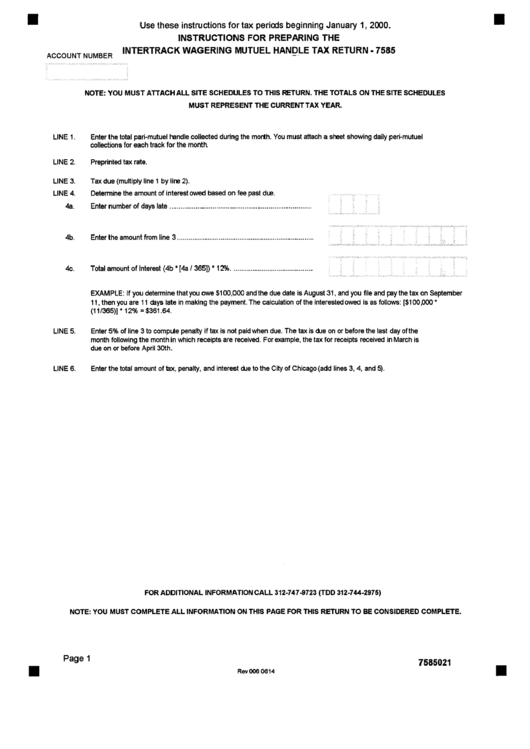

U s e t h e s e i n s t r u c t i o n s f o r t a x p e r i o d s b e g i n n i n g J a n u a r y 1 , 2 0 0 0 .

I N S T R U C T I O N S

F O R P R E P A R I N G

T H E

I N T E R T R A C K

W A G E R I N G

M U T U E L

H A N D L E

T A X

R E T U R N

-

7 5 8 5

ACCOUNT NUMBER

-

NOTE: YOU MUST ATTACH ALL SITE SCHEDULES TO THIS RETURN. THE TOTALS ON THE SITE SCHEDULES

MUST

REPRESENT THE CURRENT TAX YEAR.

II

LINE 1.

LINE 2.

LINE 3.

LINE 4.

4a.

4b.

Enter the total pari-mutuel handle collected during the month. You must attach a sheet showing daily peri-mutuel

collections for each track for the month

Preprinted tax rate.

Tax due (multiply line 1 by line

2).

Determine the amount of interest owed based on fee past due.

~ ....... .......... i ...... ..... i

i

Enter number of days late ............................................................................

; ........ i ........ ....... ~ ..... i

Enter the amount from line 3

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

4c.

LINE 5.

LINE 6.

Total amount of interest (4b * [4a / 365]) * 12% ............................................

EXAMPLE: If you determine that you owe $100,000 and the due date is August 31, and you file and pay the tax on September

11, then you are 11 days late in making the payment. The calculation of the interested owed is as follows: [$100,000 *

(11/365)] * 12% = $361.64.

Enter 5% of line 3 to compute penalty if tax is not paid when due. The tax is due on or before the last day of the

month following the month in which receipts are received. For example, the tax for receipts received in March is

due on or before April 3Oth.

Enter the total amount of tcx, penalty, and interest due to the City of Chicago (add lines 3, 4, and 5).

FOR ADDITIONAL INFORMATION CALL 312-747-9723 (TDD 312-744-2975)

NOTE: YOU MUST COMPLETE ALL INFORMATION ON THIS PAGE FOR THIS RETURN TO BE CONSIDERED COMPLETE.

P a g e 1

7 5 8 5 0 2 1

B

Rev 006 0614

B

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1