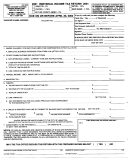

Form 37a - Individual Income Tax Return Page 2

ADVERTISEMENT

*FORM37AF03B*

DECLARATION OF EXEMPTION

FORM37AF03B

DECLARATION OF EXEMPTION

I AM NOT REPORTING TAXABLE INCOME BECAUSE:

1.

I had NO TAXABLE INCOME for the entire tax year of 2003.

(please attach a copy of page 1 of your 2003 Federal Form 1040 EZ, 1040 A, or 1040)

2.

I was a member of the ARMED FORCES of the United States and had no other taxable income the entire tax year of 2003.

3.

DATE OF BIRTH

I was under 18 for the entire tax year of 2003.

(see special notes)

MO

DAY

YR.

4.

I am a RETIRED individual, receiving only pension, social security, interest or dividend income for all of 2003.

RETIREMENT DATE

MO

DAY

YR.

5.

Prior to January 1, 2003, I moved from a RITA municipality.

DATE OF MOVE

Previous Address

MO

DAY

YR.

Address

City

State

Zip Code

DATE OF DEATH

6.

Taxpayer is DECEASED

MO

DAY

YR.

7.

I am FILING JOINTLY with spouse

SPOUSE NAME

SPOUSE SOCIAL SECURITY NUMBER

SPECIAL NOTES:

ARLINGTON HEIGHTS

MOGADORE

- Individuals under 16 years of age are exempt

- Full-time post secondary education students may

AVON LAKE

be eligible for a tax credit.

NEWTOWN

- Individuals under 16 years of age are exempt

GARFIELD HEIGHTS

- Under 18 exemption does not apply

OAKWOOD

- Individuals 62 years of age and older are entitled to a wage

exemption

- Full-time high school or undergraduate college stu-

LAKEWOOD

dents working within the State of Ohio are exempt

OTTAWA

- Full-time college students who do not reside within the city

more than 16 weeks per year are exempt

- Individuals under 19 years of age and earning no

LOCKLAND

more than $600.00/yr. are exempt

REYNOLDSBURG

- Under 18 exemption does not apply

- Individuals 65 years of age or older on December 21, 2003

- Income of the mentally retarded or developmentally

with gross taxable income of $1,200.00 or less are exempt

disabled while working for less than minimum wage

MARYSVILLE

is exempt

RIVERSIDE

- The first $1,000.00 of income earned by the mentally

retarded or developmentally disabled while working for less

- Under 18 years of age exemption does not apply

SAINT PARIS

than minimum wage is exempt

MILFORD CENTER

- Under 18 years of age exemption does not apply

SHEFFIELD LAKE

- Students under 19 years of age are exempt

- The first $1,000.00 of income earned by the mentally

- Individuals under 16 year of age are exempt

WINTERSVILLE

retarded or developmentally disabled while working for less

than minimum wage is exempt

- Under 18 years of age exemption does not apply

YELLOW SPRINGS

-Individuals under 16 years of age are exempt

Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2