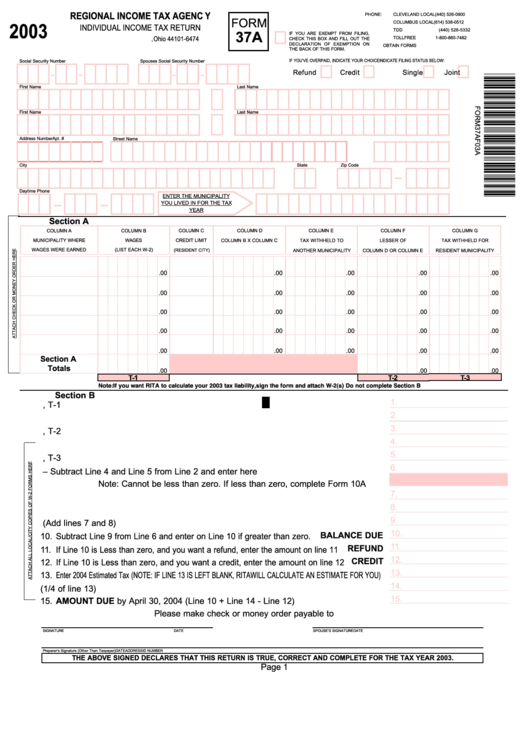

Form 37a - Individual Income Tax Return

ADVERTISEMENT

REGIONAL INCOME TAX AGENCY

PHONE:

CLEVELAND LOCAL (440) 526-0900

FORM

COLUMBUS LOCAL

(614) 538-0512

2003

INDIVIDUAL INCOME TAX RETURN

37A

TDD

(440) 526-5332

IF YOU ARE EXEMPT FROM FILING,

TOLL FREE

1-800-860-7482

P.O. Box 89474 Cleveland, Ohio 44101-6474

CHECK THIS BOX AND FILL OUT THE

DECLARATION OF EXEMPTION ON

OBTAIN FORMS AT

THE BACK OF THIS FORM.

IF YOU’VE OVERPAID, INDICATE YOUR CHOICE

INDICATE FILING STATUS BELOW:

Social Security Number

Spouses Social Security Number

Refund

Credit

Single

Joint

First Name

M.I.

Last Name

First Name

M.I.

Last Name

Address Number

Street Name

Apt. #

City

State

Zip Code

Daytime Phone

ENTER THE MUNICIPALITY

YOU LIVED IN FOR THE TAX

YEAR

Section A

COLUMN A

COLUMN B

COLUMN C

COLUMN D

COLUMN E

COLUMN F

COLUMN G

MUNICIPALITY WHERE

WAGES

CREDIT LIMIT

COLUMN B X COLUMN C

TAX WITHHELD TO

LESSER OF

TAX WITHHELD FOR

WAGES WERE EARNED

(LIST EACH W-2)

(RESIDENT CITY)

COLUMN D OR COLUMN E

RESIDENT MUNICIPALITY

ANOTHER MUNICIPALITY

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

Section A

Totals

.00

.00

.00

T-1

T-2

T-3

Note: If you want RITA to calculate your 2003 tax liability, sign the form and attach W-2(s) Do not complete Section B

Section B

1.

1. Enter total wages from Section A, T-1

2.

2. Multiply Line 1 by Tax Rate of residence municipality

3.

3. Enter allowable credit from Section A, T-2

4.

4. Multiply Line 3 by Tax Credit of residence municipality

5.

5. Enter tax amount withheld from Section A, T-3

6.

6. Line 6 – Subtract Line 4 and Line 5 from Line 2 and enter here

Note: Cannot be less than zero. If less than zero, complete Form 10A

7.

7. Estimated Tax payments made to RITA for tax year 2003

8.

8. Credits carried forward from 2002

9.

9. Total credits allowable (Add lines 7 and 8)

BALANCE DUE

10.

10. Subtract Line 9 from Line 6 and enter on Line 10 if greater than zero.

REFUND

11.

11. If Line 10 is Less than zero, and you want a refund, enter the amount on line 11

CREDIT

12.

12. If Line 10 is Less than zero, and you want a credit, enter the amount on line 12

13.

13. Enter 2004 Estimated Tax (NOTE: IF LINE 13 IS LEFT BLANK, RITA WILL CALCULATE AN ESTIMATE FOR YOU)

14.

14. Enter first quarter 2004 estimate (1/4 of line 13)

15. AMOUNT DUE by April 30, 2004 (Line 10 + Line 14 - Line 12)

15.

Please make check or money order payable to R.I.T.A.

SIGNATURE

DATE

SPOUSE’S SIGNATURE

DATE

Preparer’s Signature (Other Than Taxpayer)

DATE

ADDRESS

ID NUMBER

THE ABOVE SIGNED DECLARES THAT THIS RETURN IS TRUE, CORRECT AND COMPLETE FOR THE TAX YEAR 2003.

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2