Form Dw3 - Annual Reconciliation W2 Withholding And 1099 Misc. Earnings Report

ADVERTISEMENT

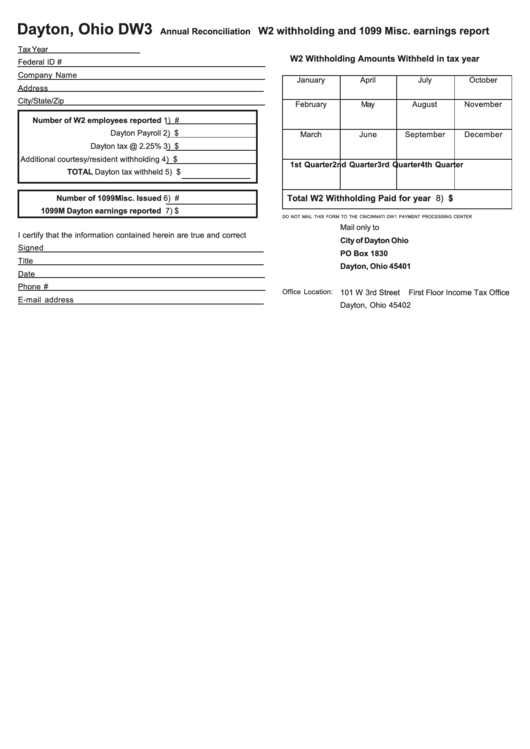

Dayton, Ohio DW3

W2 withholding and 1099 Misc. earnings report

Annual Reconciliation

Tax Year

W2 Withholding Amounts Withheld in tax year

Federal ID #

Company Name

January

April

July

October

Address

City/State/Zip

February

May

August

November

Number of W2 employees reported 1) #

Dayton Payroll 2) $

March

June

September

December

Dayton tax @ 2.25% 3) $

Additional courtesy/resident withholding 4) $

1st Quarter

2nd Quarter

3rd Quarter

4th Quarter

TOTAL Dayton tax withheld 5) $

Total W2 Withholding Paid for year 8) $

Number of 1099Misc. Issued 6) #

1099M Dayton earnings reported 7) $

DO NOT MAIL THIS FORM TO THE CINCINNATI DW1 PAYMENT PROCESSING CENTER

Mail only to

I certify that the information contained herein are true and correct

City of Dayton Ohio

Signed

PO Box 1830

Title

Dayton, Ohio 45401

Date

Phone #

Office Location:

101 W 3rd Street

First Floor Income Tax Office

E-mail address

Dayton, Ohio 45402

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1