Form Or706-A-V - Additional Estate Transfer Tax Payment Voucher And Instructions

ADVERTISEMENT

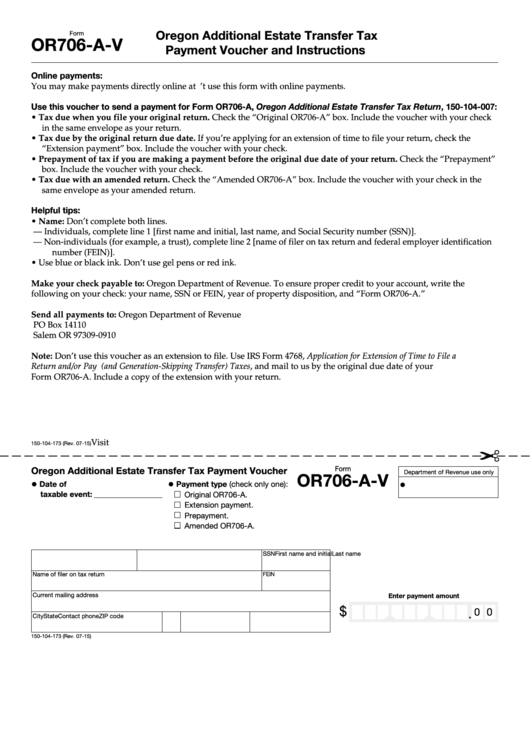

Oregon Additional Estate Transfer Tax

Form

OR706-A-V

Payment Voucher and Instructions

Online payments:

You may make payments directly online at Don’t use this form with online payments.

Use this voucher to send a payment for Form OR706-A, Oregon Additional Estate Transfer Tax Return, 150-104-007:

• Tax due when you file your original return. Check the “Original OR706-A” box. Include the voucher with your check

in the same envelope as your return.

• Tax due by the original return due date. If you’re applying for an extension of time to file your return, check the

“Extension payment” box. Include the voucher with your check.

• Prepayment of tax if you are making a payment before the original due date of your return. Check the “Prepayment”

box. Include the voucher with your check.

• Tax due with an amended return. Check the “Amended OR706-A” box. Include the voucher with your check in the

same envelope as your amended return.

Helpful tips:

• Name: Don’t complete both lines.

— Individuals, complete line 1 [first name and initial, last name, and Social Security number (SSN)].

— Non-individuals (for example, a trust), complete line 2 [name of filer on tax return and federal employer identification

number (FEIN)].

• Use blue or black ink. Don’t use gel pens or red ink.

Make your check payable to: Oregon Department of Revenue. To ensure proper credit to your account, write the

following on your check: your name, SSN or FEIN, year of property disposition, and “Form OR706-A.”

Send all payments to: Oregon Department of Revenue

PO Box 14110

Salem OR 97309-0910

Note: Don’t use this voucher as an extension to file. Use IRS Form 4768, Application for Extension of Time to File a

Return and/or Pay U.S. Estate (and Generation-Skipping Transfer) Taxes, and mail to us by the original due date of your

Form OR706-A. Include a copy of the extension with your return.

Visit to print more vouchers.

150-104-173 (Rev. 07-15)

✂

Oregon Additional Estate Transfer Tax Payment Voucher

Form

Department of Revenue use only

OR706-A-V

•

•

•

Date of

Payment type (check only one):

Clear form

taxable event:

Original OR706-A.

Extension payment.

Prepayment.

Amended OR706-A.

First name and initial

Last name

SSN

Name of filer on tax return

FEIN

Current mailing address

Enter payment amount

$

0 0

.

City

State

ZIP code

Contact phone

150-104-173 (Rev. 07-15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1